BATON ROUGE, La. — Governor Jeff Landry says the State of Louisiana is on the verge of a major budget shortfall if citizens don’t vote to fix what he and critics call a failing tax structure.

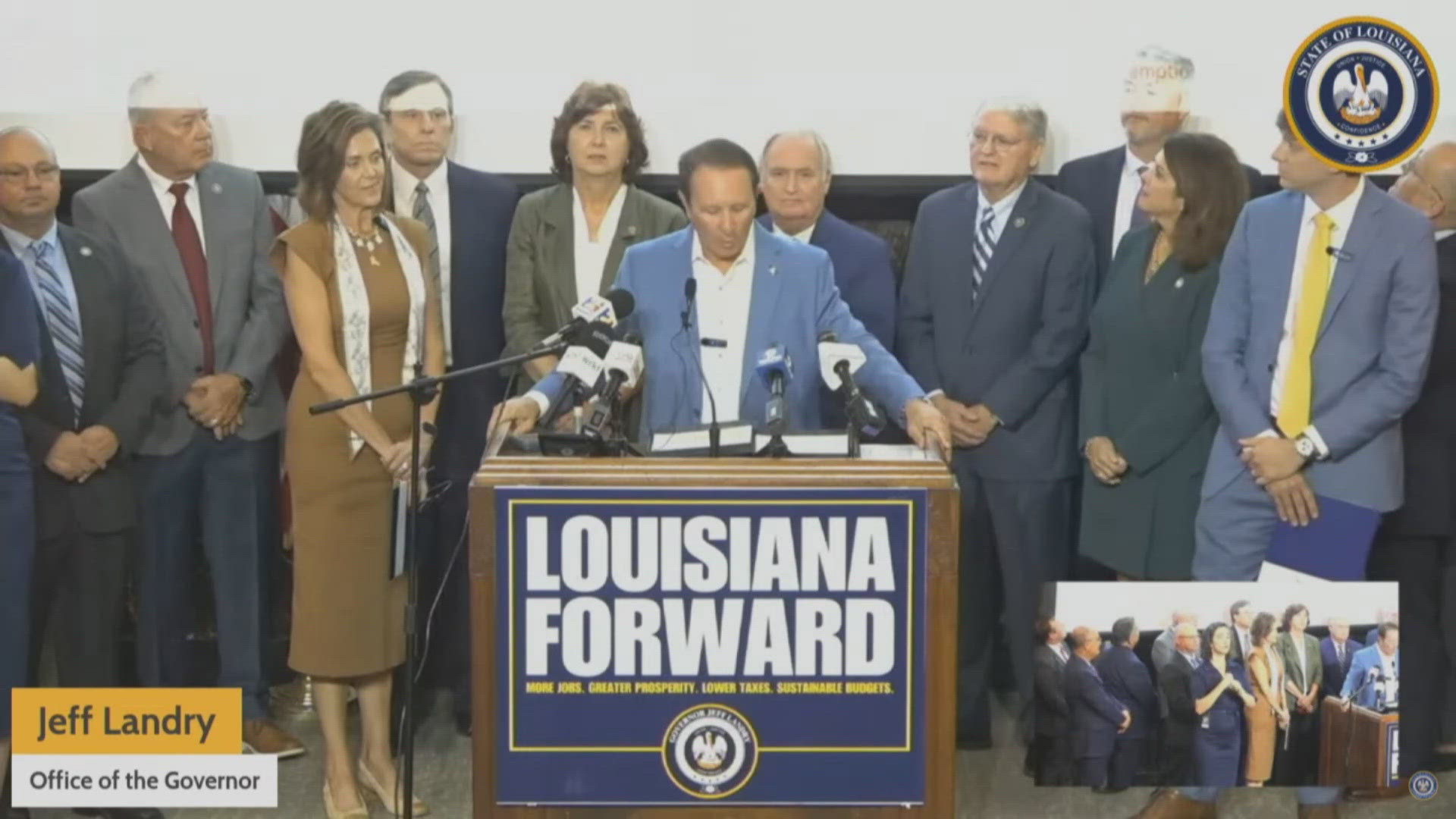

Tuesday Landry announced a plan to overhaul the system.

“The tax structure has caused Louisiana to stay at the bottom,” said Landry during a press conference Tuesday. “It inhibits job growth and economic prosperity for the state.”

“We are estimating an over $700-million shortfall,” he said. “Which possibly could balloon to 1.5 billion in the near future.”

In an effort to avoid the shortfall, Landry is proposing “Louisiana Forward” a plan he says completely overhauls the current system eliminating several credits and exemptions, increasing sales tax on some services all while lowering the tax rate.

Landry touted the plan, saying it would “provide an immediate increase in take-home pay for every Louisiana taxpayer.” The governor said under that plan, he believes Louisiana will be on ”the road to reducing or eliminating the income tax" by 2030, an idea that has been pushed by other Republican officials including State Treasurer John Fleming and Revenue Secretary Richard Nelson.

Currently, there are nine states that do not levy an individual income tax. Among those are the nearby states of Florida, Tennessee and Texas.

Landry said that while his plan does not include increasing the current rate of sales tax, he does believe the tax should be expanded to include other items and services such as lobbying, dog grooming and car washes. Currently, there are 223 sales tax exemptions, Nelson said.

According to information from the state's revenue department, Louisiana residents currently pay a 4.25% tax rate on income $50,000 and above, 3.5% on income between $12,500 and $50,000, and 1.85% on income $12,500 and below. Landry’s proposal would eliminate income tax for those making up to $12,500 and would set a flat income tax rate of 3 percent for those earning above $12,500.

Steven Procopio with Public Affairs Research of Louisiana, a government watchdog agency, says he’s optimistic about the plan given the state’s current complicated system.

“It’s a terrible tax structure,” said Procopio. “We don’t have a really heavy tax burden, I know it feels like it, but we have really high tax rates. It’s a really high rate and a whole bunch of exemptions and credits.”

Some of Landry’s plans would eliminate taxes on prescription drugs, provide pay raises for teachers and align the state's sales tax more efficiently while dropping the corporate tax rate from 7.5 to 3.5.

“Everyone will probably end up paying less. Some of that will be made up with people paying more on the sales tax,” said Procopio.

Overall, Procopio believes the plan could help the state be more competitive but it’s not a silver bullet.

“I think an even bigger issue is workforce,” said Procopio. “How are we educating our people? Businesses move to Texas because they have a strong workforce. So we're going to have to improve that, as well.”

In a statement, PAR Louisiana said it believes comprehensive, responsible tax reform is long overdue. The state’s tax system is cluttered with too many exemptions, deductions and credits. It contains outdated, uncompetitive taxes that are out of step with the rest of the country.

That is why PAR applauds the attempt from Gov. Jeff Landry and his administration to revamp Louisiana’s tax structure. They are taking a comprehensive, thoughtful approach to a complex issue, and at this early stage, they seem largely headed down the right path.

Governor Landry plans to call the state legislature into a special session in November to get feedback on the proposal.

If approved, voters will have the final say at the polls in March.