NEW ORLEANS — "We're leaving behind the old way we're coming in with a new Louisiana way," said University of New Orleans Political Scientists, Dr. Edward Chervenak.

The desire to change Louisiana's tax system has been talked about for decades.

Now, you will be asked to decide four changes to the Louisiana constitution.

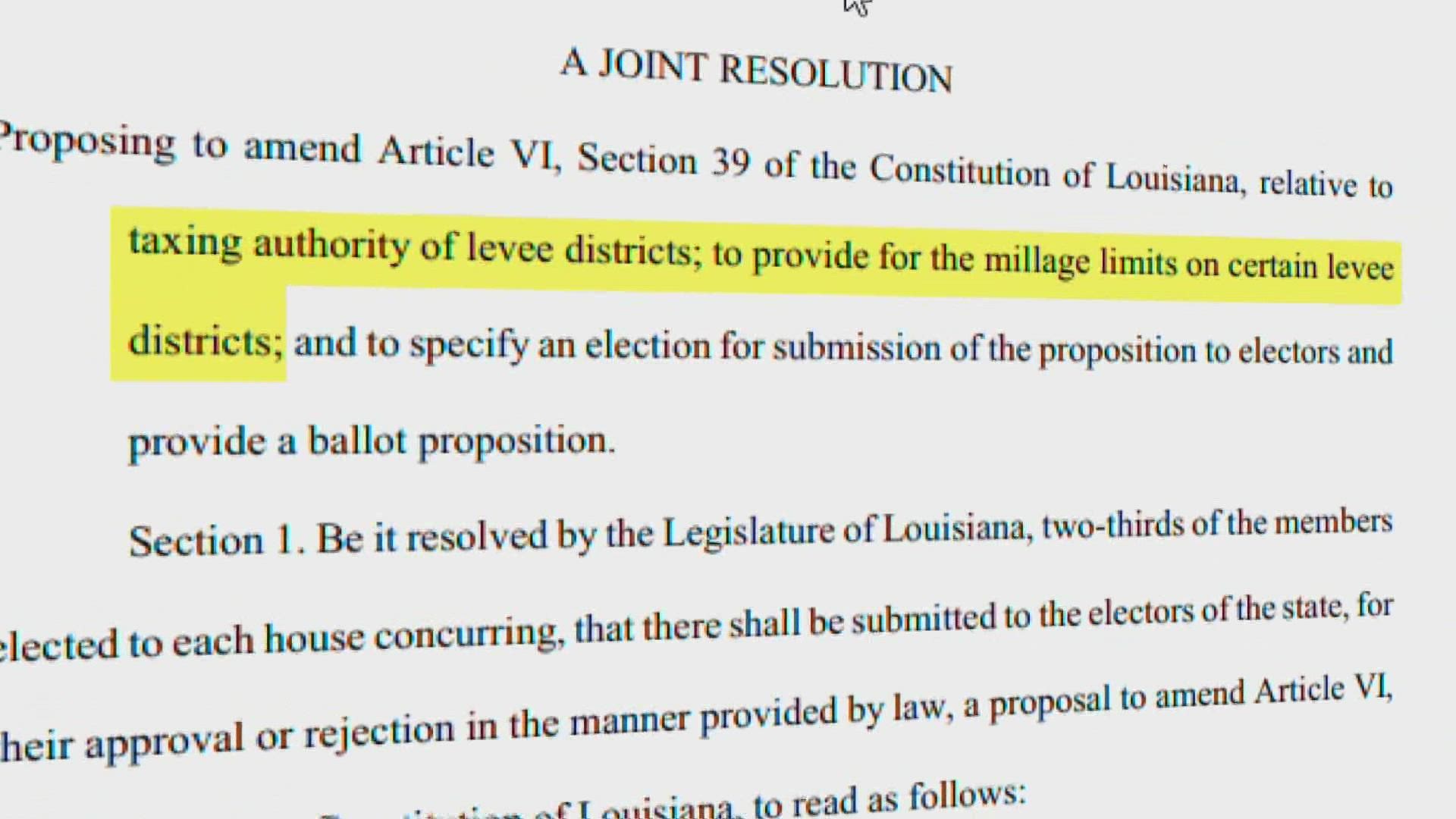

One of the four amendments on the ballot would allow five levee boards to raise taxes, something levee boards created before 2006 already have the authority to do.

"Allow the levee boards a bit more freedom, in terms of, being able to generate revenue rather than having to get permission from the voters each time they want to," Dr. Chervenak said.

Another allows a little bit more room to tap protected funds when revenues are down.

"So that higher education and health care aren't taking the brunt of the cuts," said Dr. Chervenak.

But it's the first two amendments that have garnered attention.

"These are both tax reform proposals that have long been sought after by business interest in the state," Dr. Chervenak said.

He said that with a business-friendly legislature in place these long-awaited tax reforms are finally moving toward a vote.

Amendment one suggests appointing a commission board, four locals, four state officials, to handle tax collection.

The commission will only be able to act after a 2/3 vote.

"It makes tax collection here in Louisiana more centralized, more efficient," he said.

If passed legislation has to outline how the process will work, unlike previous ballot items.

While, amendment one will not change the sales tax rates, which is one of the highest in the nation, amendment two will lower income tax rates.

But, Dr. Chervenak explained one pitfall.

"It is a reduction in the tax rates but also the loss of the deduction for federal taxes," he said.

This amendment would also greatly impact businesses.

"The goal here is, not just to lower income tax rates for individuals, but also to reduce taxes on businesses, primarily franchise taxes," the political science professor said, "This is a deterrent for businesses to move here because not only are you having your annual income tax but now your assets are being taxed as well."

Both amendments businesses believe will create more jobs.

"We're trying to move into the 21st century where we're attracting high tech businesses cause that's where the future is right now. This is their effort to kind of signal to the business world that here is a place that you can do business now," Dr. Chervenak said.

Now it's up to the voters to understand both sides of all four amendments and make informed decisions for the postponed November 13 elections.

"A lot of it is how this argument is going to be framed," said Dr. Chervenak.

You can learn more about these amendments on the Public Affairs Research Council of Louisiana website.