NEW ORLEANS – City leaders give many homeowners good news Tuesday, announcing potential reductions in the cost of flood insurance.

After Hurricane Katrina, not only were residents trying to fix their homes, but many faced high flood insurance prices.

Perry Treme moved to Lakeview from Mid-City after Katrina, but high insurance rates almost made it impossible.

“I had a hard time buying this house here because I couldn’t get flood insurance, it was impossible to get flood insurance right after Katrina” explained Treme.

Tuesday, Mayor Mitch Landrieu announced that over 97 percent of the properties in New Orleans are going to see a potential reduction in the cost of flood insurance.

“A couple of years ago we were very fearful that without these investments, without looking at the hard things the city of New Orleans was going to be a very difficult place to live in because of the high cost of insurance,” said Landrieu.

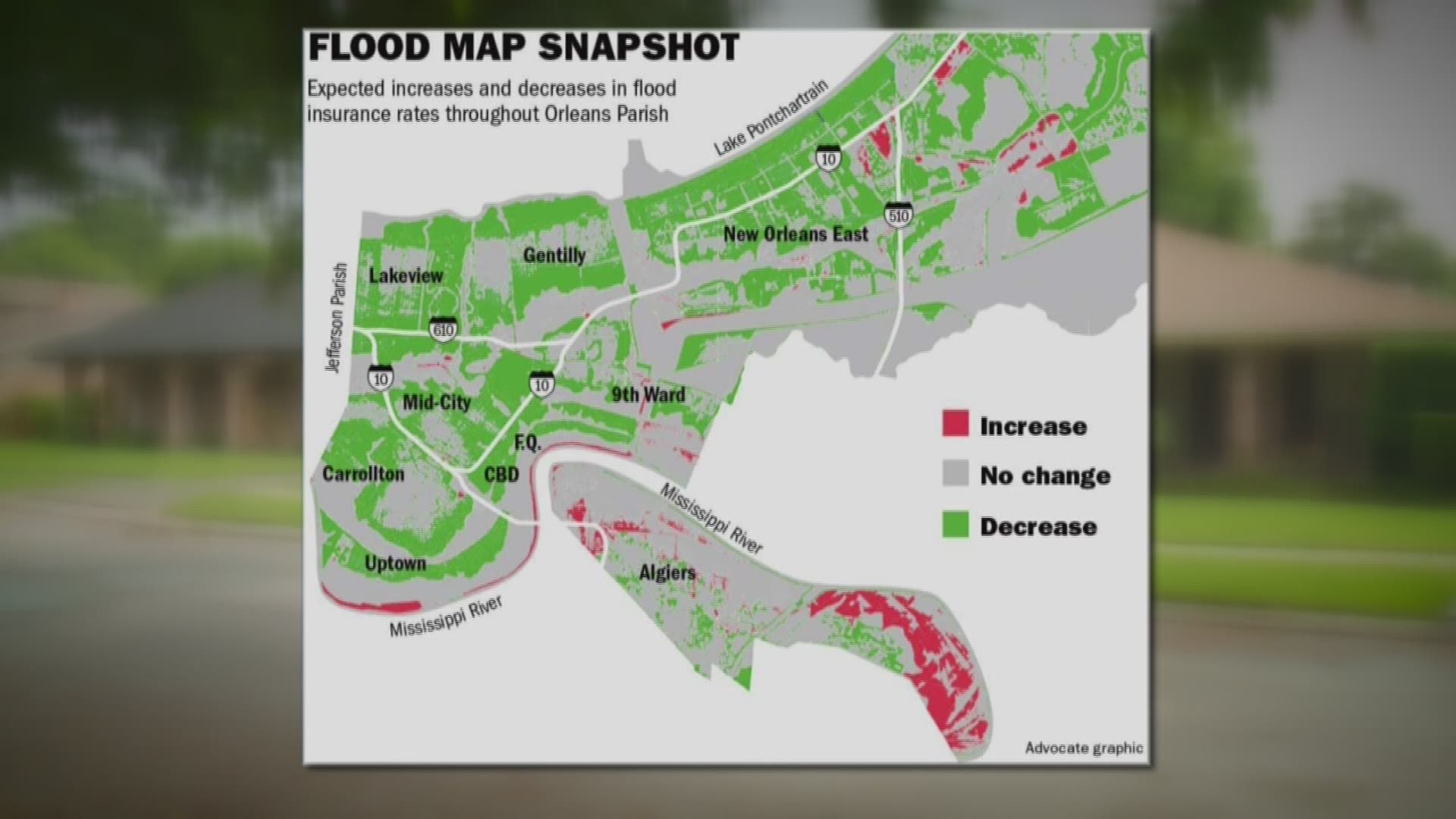

FEMA recently released new flood risk maps showing that 53 percent of properties will see a significant decrease. Rates will stay the same for 44 percent of homes, and for 3 percent, rates will increase.

The areas likely to see increases in Algiers. The reductions in the flood rates will be seen in New Orleans East, Gentilly, Lakeview, and Broadmoor.

The Landrieu administration explained the new flood maps are a result of the cities recent infrastructure investments.

“We started with hurricane protection system with the $14 billion for the outer layer of 200 miles of levee and floodwalls, said Cedric Grant, executive director of the Sewerage and Water Board.

The changes will potentially help protect the pockets of people like Treme.

“It would make quite a difference, still doing repairs on my house,” said Treme.

These decreases are supposed to go into effect on September 30. The city will be eligible for an additional 15 percent reduction in flood insurance rates in 2017. WWL-TV was told homeowners will need to contact their individual insurance companies, who will be able to apply the new rates.