NEW ORLEANS — With the sales tax bills still being debated at the legislative level, we don’t know how much more we’ll pay in newly implemented sales taxes, but how much could you save, if lawmakers lower the income tax?

Right now, Louisiana taxes income based on a tiered system. Single or married people are taxed based on how much they make; from 1.85 percent to 4.25 percent.

Governor Jeff Landry’s new tax bill wants to make that a flat 3-percent state income tax across the board and to eliminate income taxes for the bottom tier of tax filers.

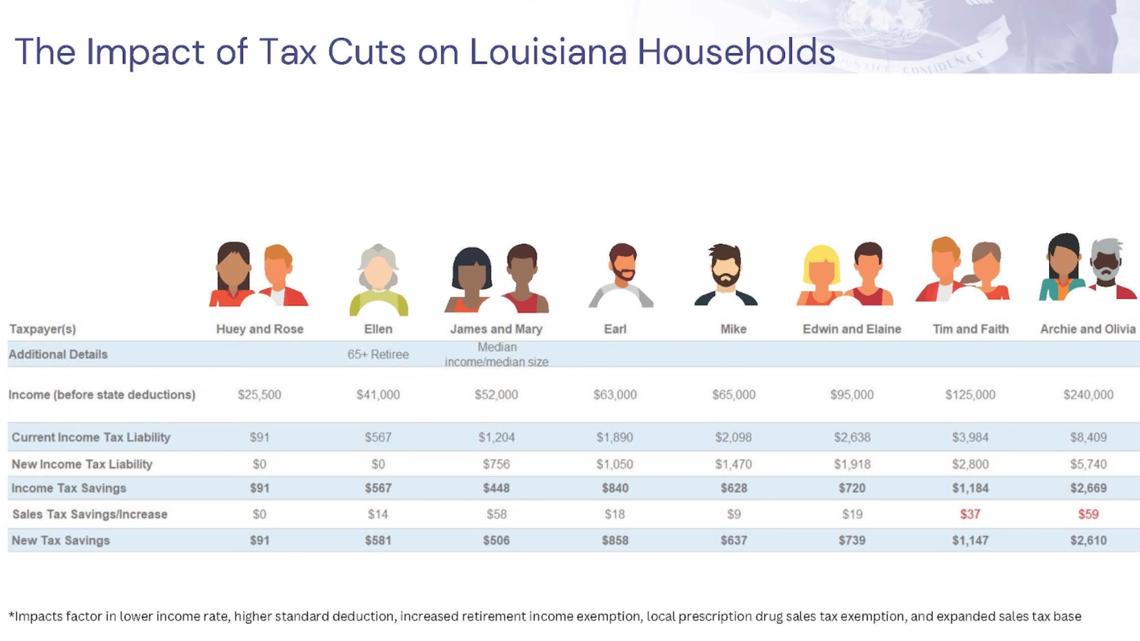

His office has released a graphic of the change you’d see after the income tax cuts, but it also factors in some deduction changes and exemptions currently being debated in the legislature.

RESET Louisiana, in partnership with PAR, both non-partisan organizations, hired a financial analyst to deep dive into Landry’s proposed plan. They released a detailed report on the proposed income tax impact, which does not factor in any possible tax credits.

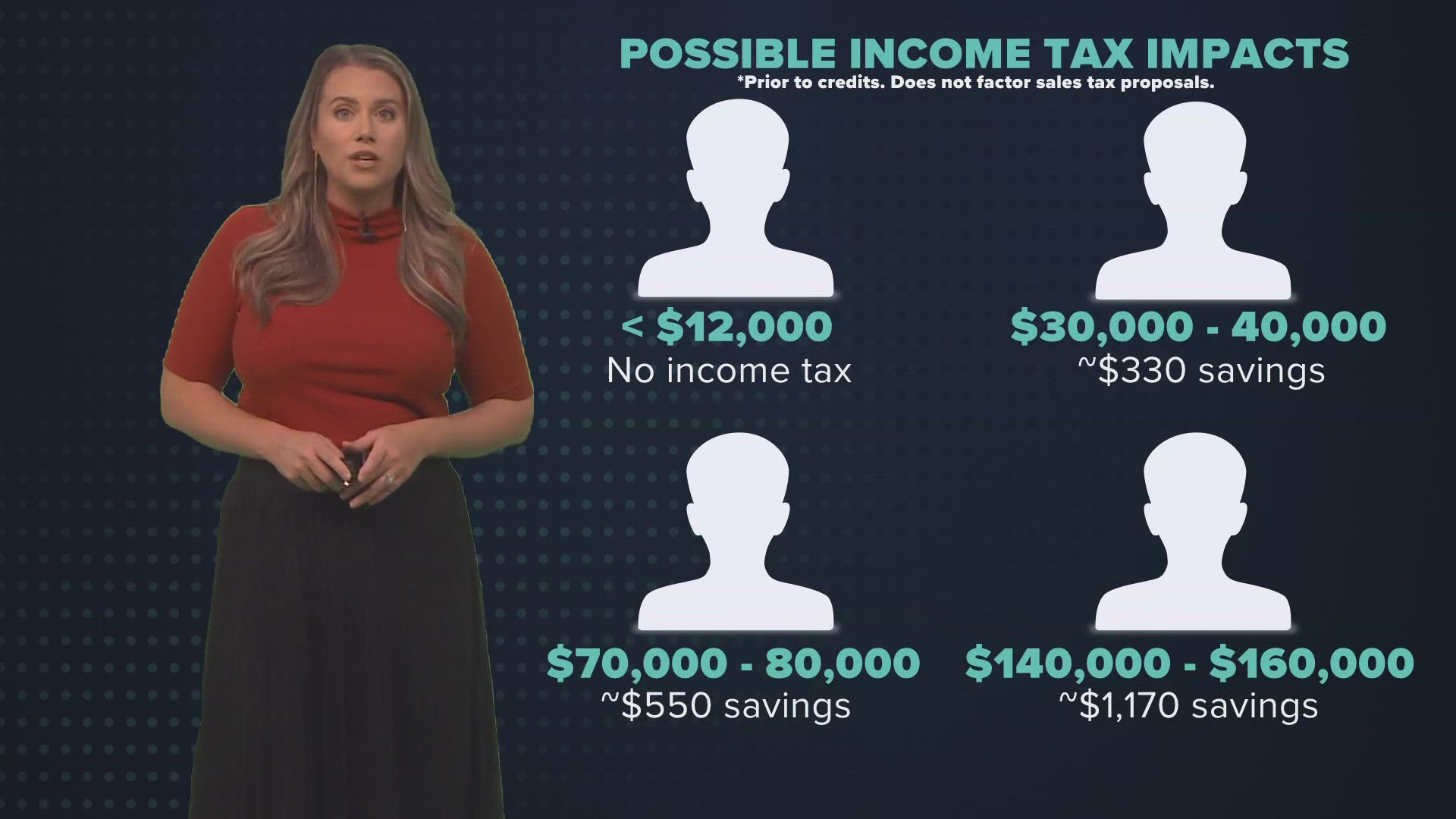

Per their math:

- A single person making less than $12,000 will pay no income tax.

- A person making between $30,000 to $40,000, which is the majority of Louisianians, will save about $330.

- An individual making between $70,00 and $80,00 will save about $550.

- And once a person’s income goes over $140,000, they start to save more than $1,000 on income tax annually.

Figuring out how much you’ll pay is not as simple as doing the math between the current tax rates and the proposed 3 percent, because so many other factors are part of the big equation.

RESET Louisiana’s analyst does write that those at lower income levels will see the largest percentage change in what they pay, although the actual dollar amount is much less than those at higher income levels.