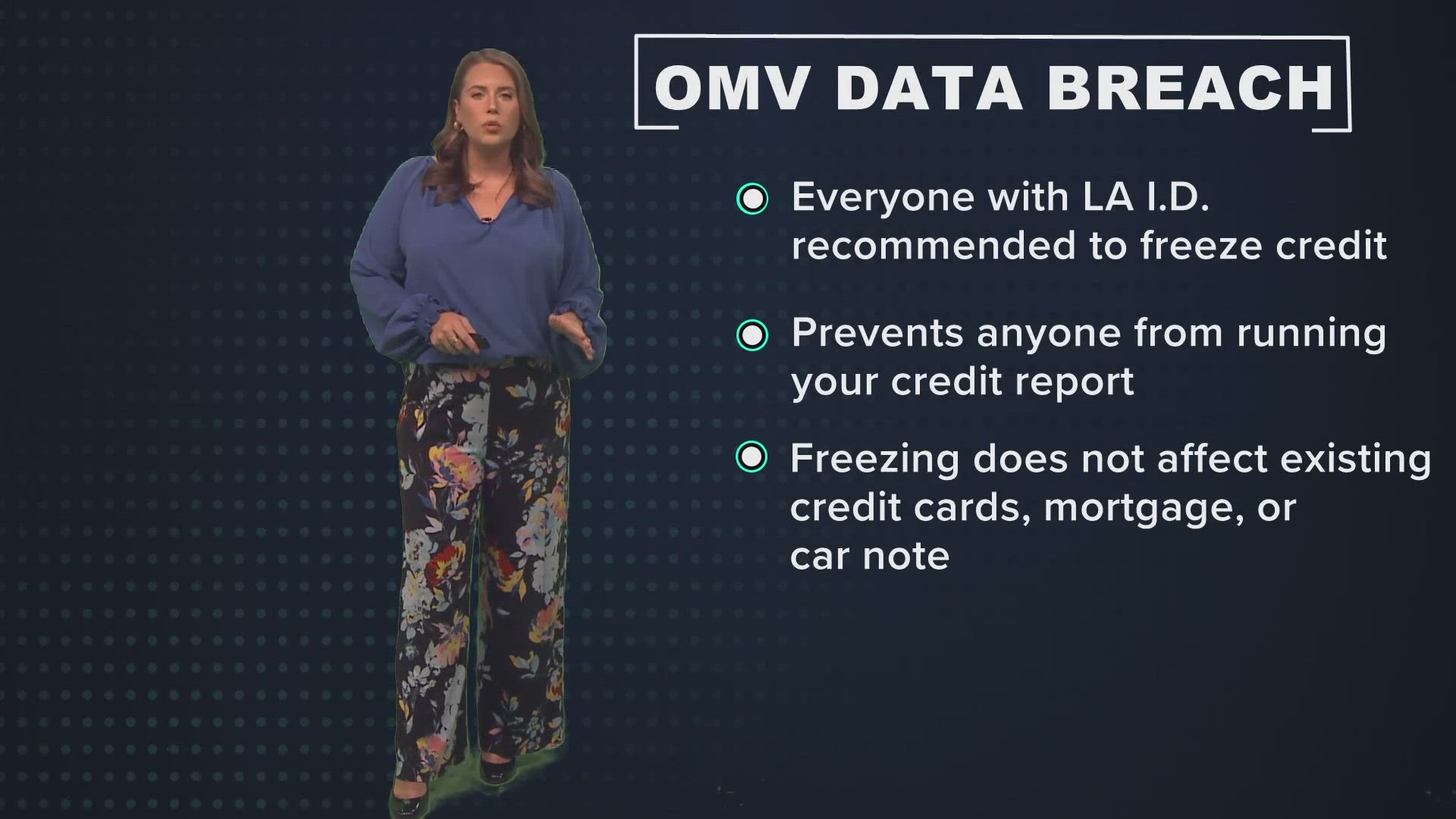

LOUISIANA, USA — After millions of Louisiana residents’ sensitive data was leaked, the state is recommending everyone freeze their credit.

But how do you freeze your credit and what is it going to protect?

When your sensitive data is for sale on the dark web, it can be easy for a scammer to open a fraudulent line of credit in your name. That could destroy your credit or put you on the hook for debt that isn’t yours.

When you place a security freeze, no one can run your credit report, with few exceptions.

This has nothing to do with your existing credit cards, mortgage, or car note. It will just help prevent a scammer from opening up a new line of credit in your name.

Here’s how to do it.

There are three major credit bureaus:

1-800-685-1111

1-888-397-3742

(888) 909-8872

You will have to contact each bureau individually online, by phone, or by mail, and ask to freeze your credit.

It takes about 10 minutes total to fill out all the forms and freeze your credit online. You’ll be assigned a PIN number to unfreeze your credit quickly in the future.

You might need to unfreeze your credit one day if you’re trying to buy a new car or home, applying for a rental property, applying for a loan, or going through any process where you’ll have to have your credit report drawn to assess your ability to pay.

Some answers to frequently asked questions:

Freezing and unfreezing is free through all three bureaus.

It will not affect your credit score.

The freeze on your credit will last until you remove it.

Parents and guardians can freeze credit for a child under 16.

Adults can also freeze credit on behalf of a spouse or incapacitated adult.

Freezing your credit will not affect or protect your bank accounts or existing credit cards.

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.