NEW ORLEANS — Wednesday the Fed announced a half-percentage-point cut, which is more than what was expected. The benchmark rate is now at 4.75%.

It will bring some relief to you if you’re looking to buy a home or a car, or if you’ve got credit card debt. But experts aren’t sure how fast those rates will come down.

Credit card interest rates have been near a record, and Edmunds says many car shoppers have held off because of high interest rates.

For those hoping to buy real estate, many mortgage interest rates may see a more significant drop than projected. Currently, the rate is at about 6.29%, though there’s still the struggle of high housing demand and low inventory.

With inflation at around 2.5% and the unemployment rate on the rise, economists believe this will help move the economy along. More cuts are expected this year and over the next two years.

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.

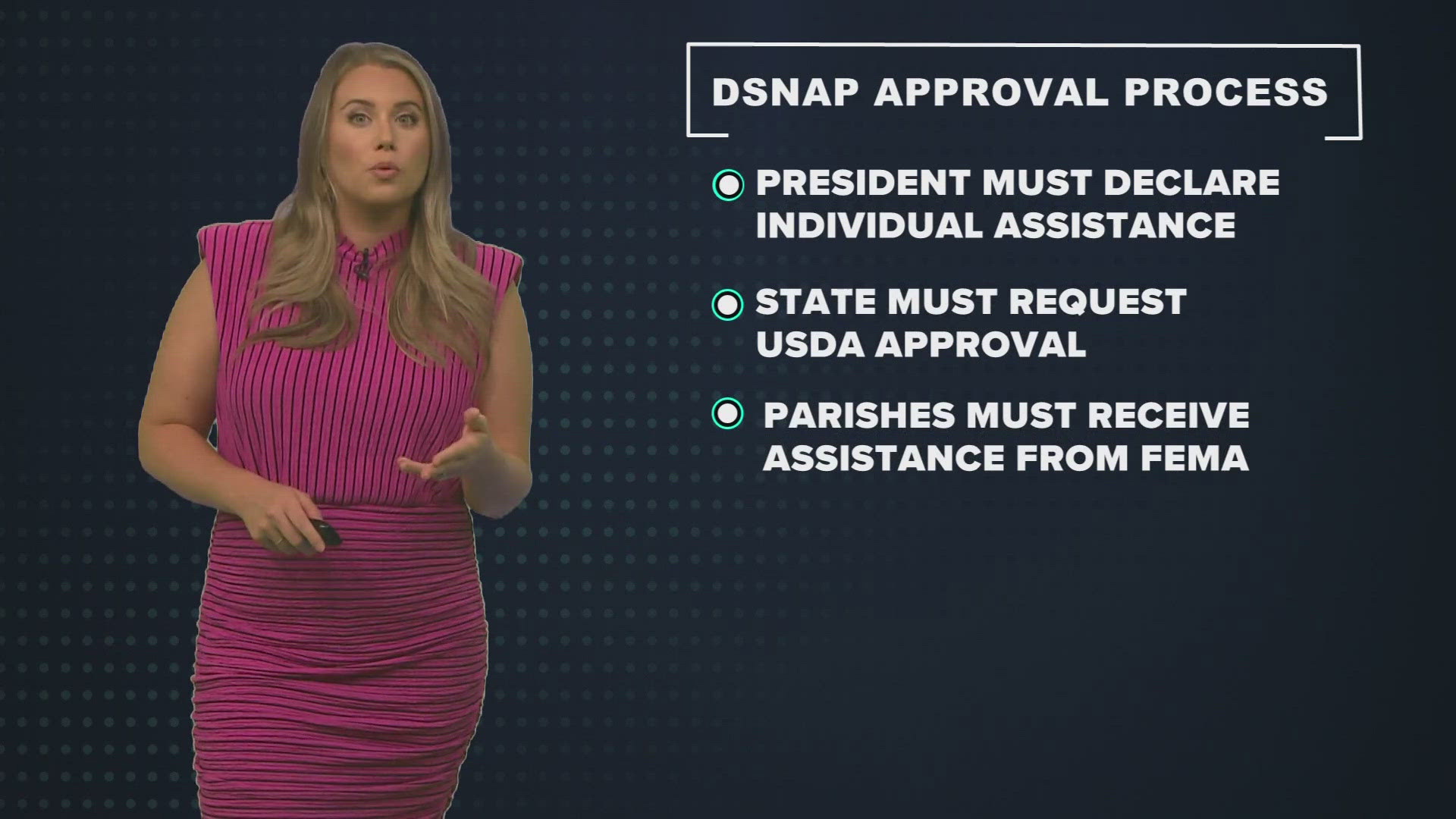

Video | The Breakdown: Louisiana seeking DSNAP approval for 8 parishes