BATON ROUGE, La. — Governor Jeff Landry has put forth a package of bills — which he emphasized more than five times to lawmakers Thursday morning — designed to work together and operate essentially as one bill.

There are 20 House bills alone, which touch on different parts of the tax code. The bills lower income tax, but raise some sales tax.

In an introduction Thursday, Governor Landry said the tax code has remained unchanged since 1974. He described it as outdated, inefficient, and a barrier to progress.

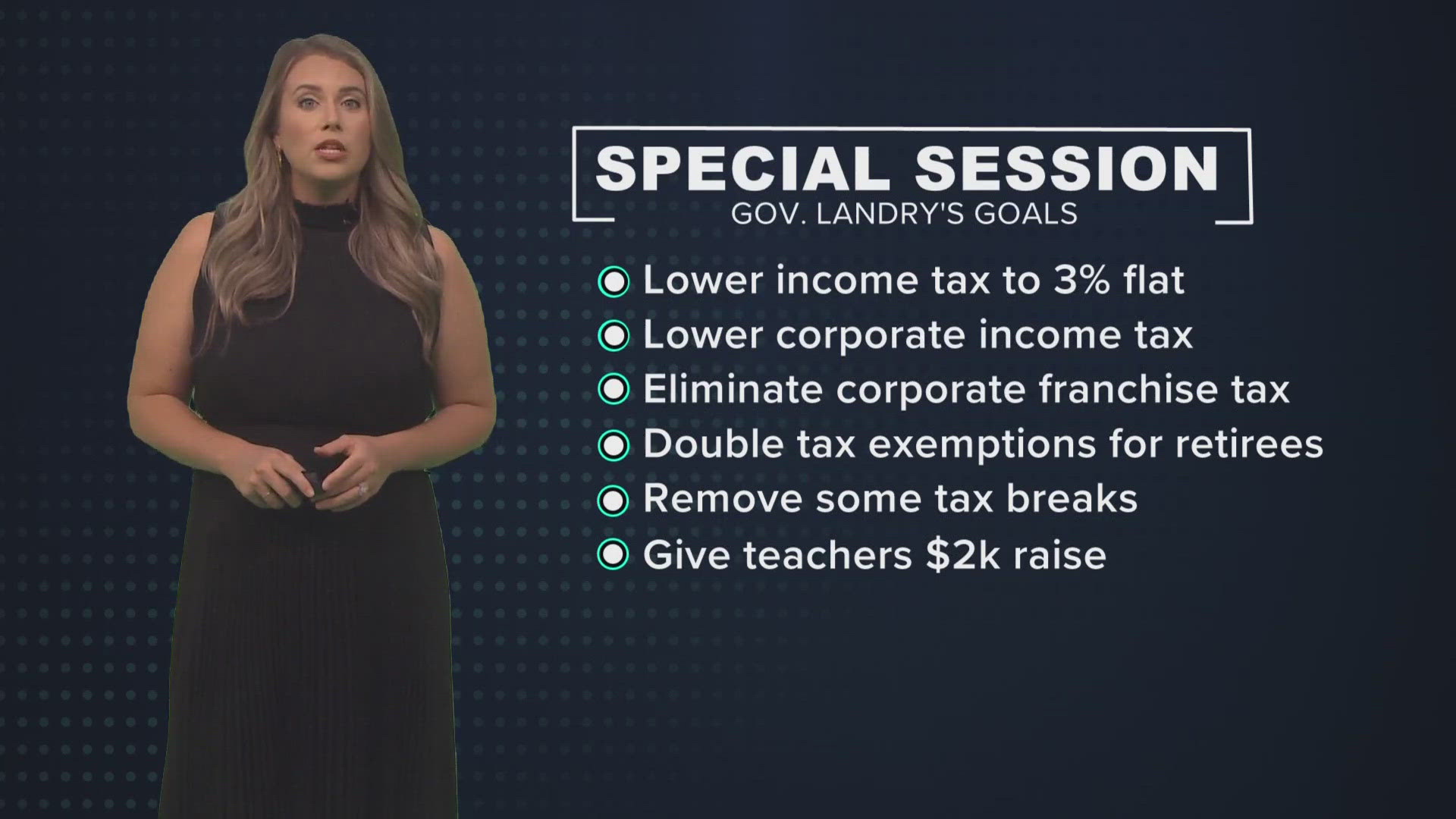

His specific goals include:

- Lowering the personal income tax to a flat 3 percent, removing the graduated scale of rates and brackets.

- Lowering the corporate income tax.

- Eliminating the corporate franchise tax.

- Doubling tax exemptions for retirees.

- Removing some tax breaks.

- Giving teachers a $2000 dollar pay raise.

But to accomplish that, Landry hopes to broaden the sales tax base by extending a 2 percent sales tax on business utilities, ending some exemptions on sales tax, and adding a sales tax to some services that currently don’t have it.

There is some concern from lawmakers that this will leave a funding gap, and that this special session is rushed with so many bills to consider.

The session resumes Friday and must wrap by Nov. 25.

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.