BATON ROUGE, La. — A whole package of bills are being considered right now, which work together to achieve one major goal: lower income tax and close the financial gap with new taxes.

First, the big picture:

If everything passes as-is, you’ll be paying less in income tax: a flat 3 percent.

The corporate income tax will decrease to 3.5 percent by 2026.

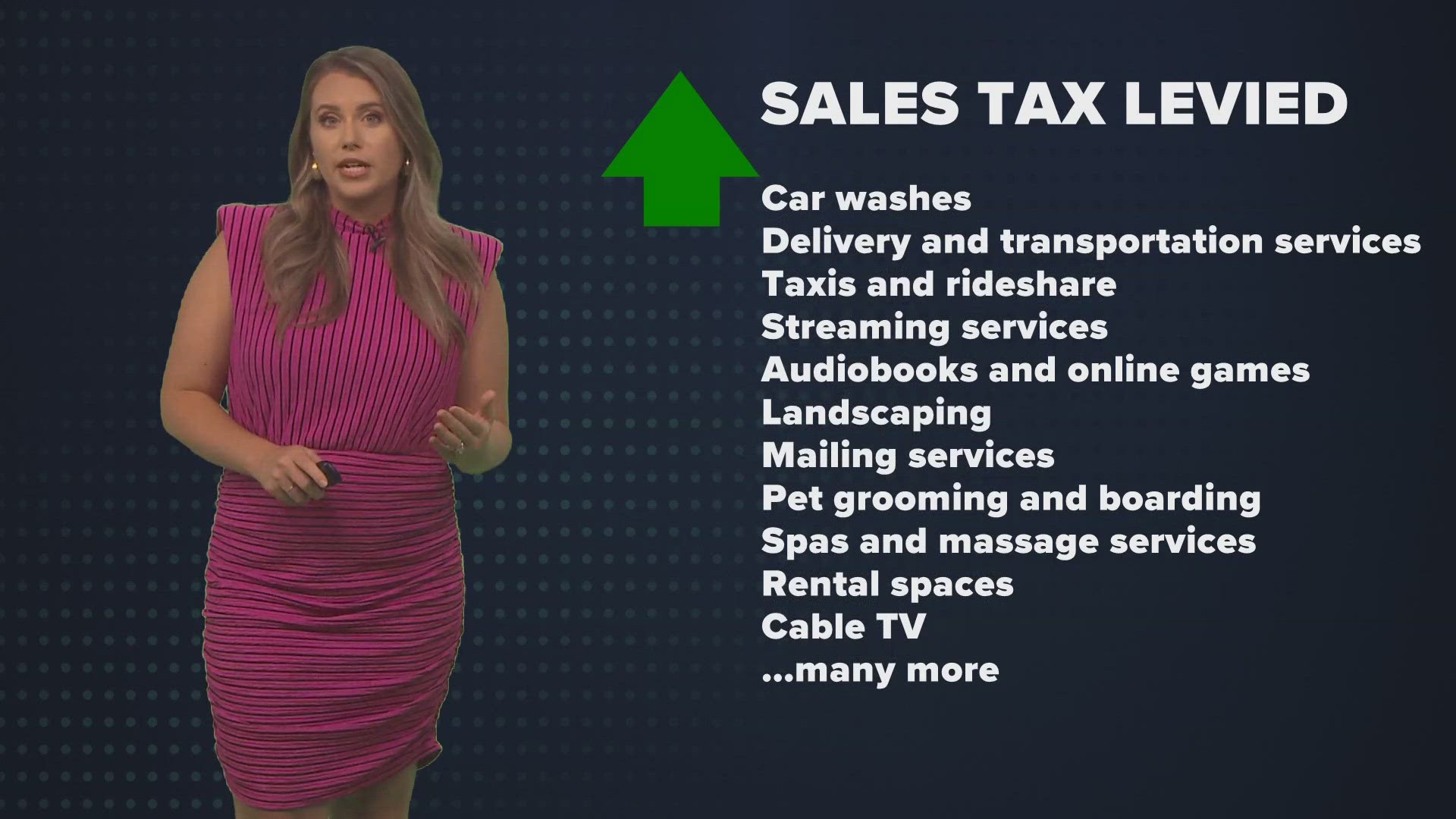

However, you’ll have to start paying sales tax on an extensive list of services and items. That includes: car washes, delivery and transportation services (including taxis and rideshare), streaming services, audiobooks and online games, landscaping, mailing services, pet grooming and boarding, spas and massage services, rental space for places like weddings and parties, cable TV, and many more. And that’s just what’s laid out in House Bill 8 and House Bill 9.

Another bill, HB10, aims to repeal tax exemptions or rebates on a long list of things like breastfeeding items, feminine products, diapers, some religious literature, new school buses, toy donations, museum admission, and some exemptions granted to nonprofit organizations and construction businesses.

Wednesday, the House passed four bills, including passed House Bill 2, which lowers corporate income tax and rolls back many tax exemptions. The most controversial of those exemption roll-backs includes the film tax credit.

To see the fiscal note for HB2, click here.

The House also passed HB8, which will tax your streaming services and other digital media, but could generate 40-million dollars per year.

To see the fiscal note for HB8, click here.

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.