ST. TAMMANY PARISH, La. — Roughly 145,000 St. Tammany homeowners will be getting their 2024 tax assessment from the Assessor's Office over the next few days.

Mandeville homeowner, Mike Otillio, already received his and has sticker shock.

“I believe it’s way too high," Otillio said.

He's not the only homeowner who thinks so. The assessments have sparked conversation on social media.

So much so, that the Assessor's Office website now states: "There is a lot of misinformation being shared currently on social media that demonstrates a lack of knowledge and understanding of the taxing process and the Assessor’s role in it."

For Otillio, there's no denying the more than $2,500 increase.

“When we talk about groceries, gasoline, everything that goes into the operation of a home, a family, it’s a major concern," Otillio said.

Otillio said he hasn't done any major renovations or improvements to his home.

"Why the increase? Why is that so important?” Otillio said.

The parish assessor is required by state law to reassess properties every four years.

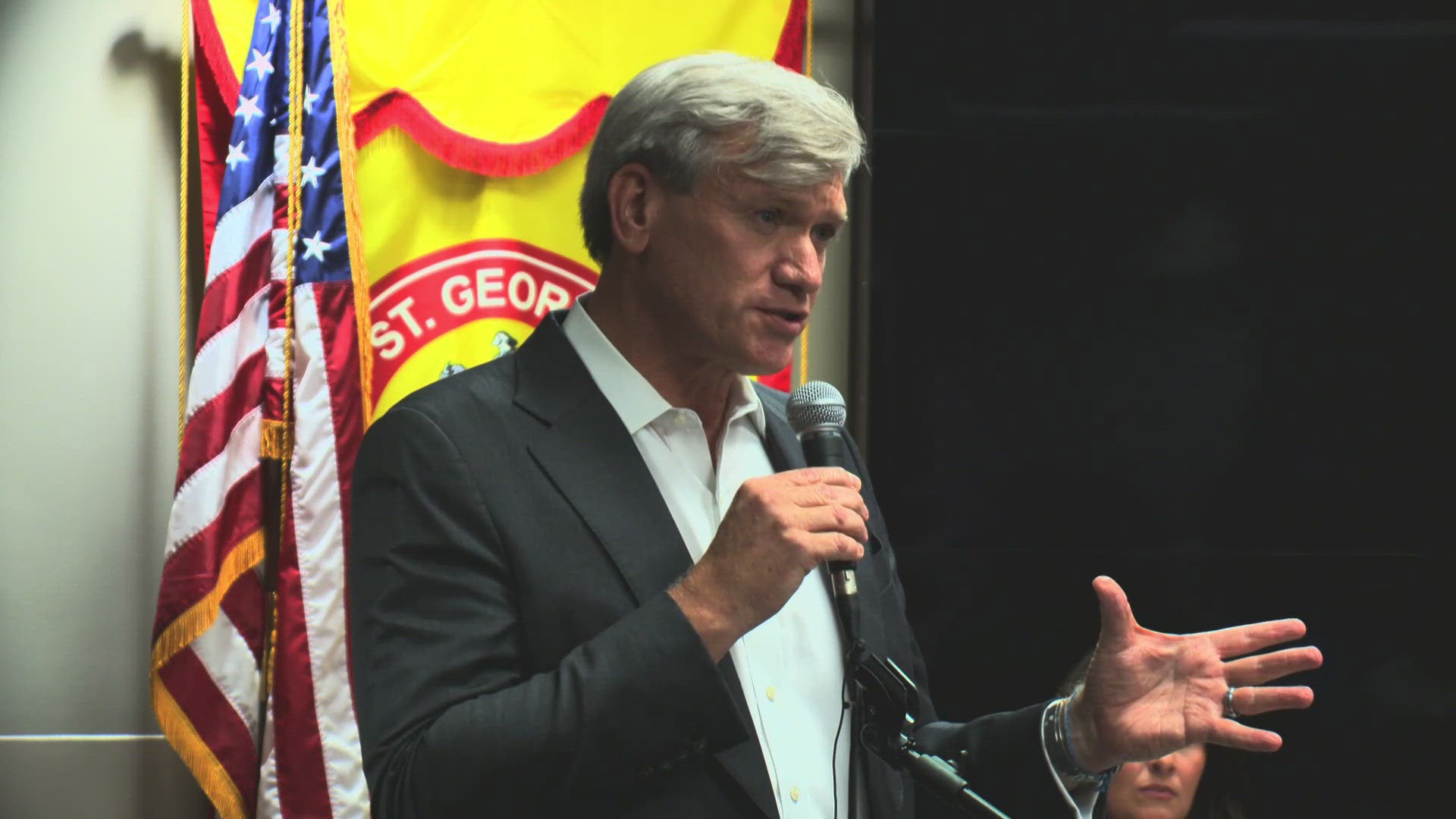

St. Tammany Chief Deputy Assessor, Troy Dugas, said that in 2020 the average increase was around nine percent. In 2024, it's around 20 percent.

“So, it’s numbers like we’ve never seen," Dugas said.

“That’s well above what would be considered reasonable in my opinion," Otillio said.

1,600 homes in the parish, including Otillio's, increased by more than 50 percent and qualify to phase in the tax increase over the next four years, according to Dugas.

The assessment is based off of the value of your home in January of 2023, Dugas said.

“I think there’s a misconception of that because we have not seen the values go down. It may have in other parishes, but we have some supply issues on the Northshore," Dugas said.

St. Tammany Parish also has one of the highest millage rates in the state.

Some taxing bodies have already voted on whether or not to roll back millages to help take the pressure off of property owners. St. Tammany Parish and the City of Mandeville have not yet voted, Dugas said.

“We have this bad combination of high millage rates, high values, and a great dependence upon individual homeowners," Dugas said.

Otillio said he understands that the parish has high millages.

“The assessment is one portion, the millage is another," Otillio said.

That's why Otillio, and many of his neighbors, plan to file an appeal.

"At the end of the day, the only thing we are really responsible for is one thing, what is your house worth? And if you think we assessed that house for more than what you think that house is worth, file an appeal," Dugas said.

You can file for a review of your assessment between Aug. 29-Sept. 13. If you do not agree with the review, you can then file for an appeal with the parish council.

The tax rolls will be certified in October, Dugas said.

For more information, visit the Assessor's Office website.

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.