NEW ORLEANS — New Orleans home and building owners will notice a jump in their property taxes when they receive their next city tax bill after the NOLA Public School board voted unanimously to raise its rates by about $30 million.

The school district claimed the hike was needed to offset a reduction in state funding and the loss of federal pandemic recovery money.

“This is an investment, overall,” NOPS CFO Stuart Gay said. “It has a positive impact, not just on the students and the teachers, but also on the community as a whole.”

The New Orleans City Council urged taxing agencies, including the school board to cut rates this year after overall property assessments in the city jumped by about 18-percent. That’s on top of steep increases in the price of insurance housing and utility costs and inflation.

“I stand firm, as do other council members that we want to do whatever possible to reduce costs to the people of the city of New Orleans and that’s what we will continue to try do,” N.O. City Council VP Helena Moreno said.

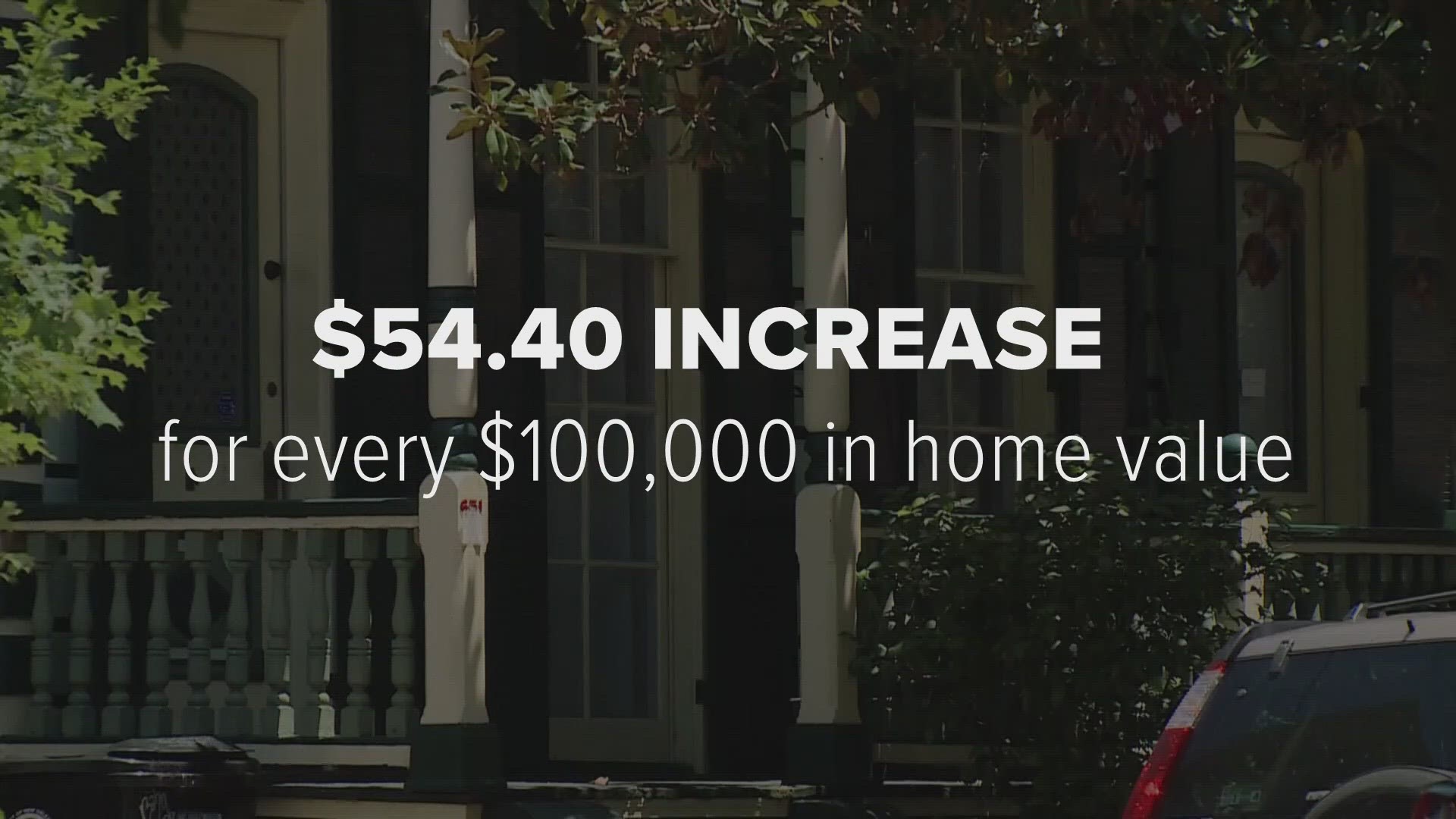

According to the school board, the average home valued at $250,000 would see about a $100 a year increase in property taxes.

Greater New Orleans Housing Alliance President Andreanecia Morris said even a modest tax increase would result in more student homelessness and displacement.

She noted landlords would likely raise rents to pay the higher taxes.

“Their issue is and we understand that they have shortfalls because of enrollment issues,” Morris said. “We know that those enrollment issues are rooted in this affordable housing crisis. So, making it worse doesn’t solve your problem.”

The tax dollars will be used to fund schools directly with much of it going to instructional activities.

City property tax bills typically go out in December, but they were delayed while the school board decided whether to raise its millages.

Taxpayers should now receive the bill in the coming weeks.