NEW ORLEANS — It’s the biggest investment most of us will ever make, but our homes can also house financial strain when it comes to storms.

“A lot of people are waking up and saying, ‘Oh my goodness, I should have prepared sooner, or I should have done more,’” said CEO of Build SOS Andy Kruger.

Kruger says Build SOS is a company dedicated to community preparedness and resiliency. He says there are crucial steps to take before and after a storm to protect both your home and money.

“At the very least what we recommend you do is go outside, as long as the weather is safe, go outside and take eight pictures of your house,” said Kruger.

That’s every flat side and every corner. That way you have pictures to justify insurance claims and could even get a larger payout. If your home is damaged, Kruger says be aware of contractor fraud.

“Following a storm there is a great opportunity in all the chaos for bad actors to come in and pretend to be helpful and play on your sense of urgency,” said Kruger.

Kruger says remember to card your contractor. Ask if they’re licensed and insured. Then, take the time to look them up on the secretary of state’s website.

“The message is don’t become a victim twice,” said Build SOS board member Chuck Marceaux.

Marceaux is the former executive director of Louisiana’s contractor licensing board. He saw firsthand in the aftermath of Hurricanes Katrina and Rita how costly unlicensed contractors can be.

“People were desperate. They would lay down a 30, 40, 50 percent down payment when it should be no more than 10 percent by our standards and recommendations and they’d get ripped off,” said Marceaux.

“If a community is going to recover, let’s do it in a more resilient way so that next storm that comes in, we don’t have the same thing happening again,” said Build SOS board chairman Billy Ward.

Ward has been building homes for more than 40 years. He says the best way to avoid losing money to rogue contractors is through research.

“You want to do all that pre-storm. The way you do it is, have a list of confident, compliant contractors,” said Ward.

That way they’ll be ready to go, so you can focus on repairing your home instead of your finances.

Ahead of storms, it’s also a good idea to read over your insurance policy and discuss any possible out-of-pocket expenses with your insurance agent. Louisiana Insurance Commissioner Tim Temple issues the following tips for Louisianans.

“All Louisianans should stay informed and take necessary precautions as this storm approaches,” Commissioner Temple said. “Prepare your property by trimming your trees, buying supplies and creating a home inventory. Have an evacuation plan in the event your area becomes too dangerous. And be insurance ready, which means review your policy, discuss potential out-of-pocket costs with your agent and keep their information handy in case you need to file a claim.”

The Louisiana Department of Insurance (LDI) offers the following tips for preparing for an imminent hurricane or tropical storm landfall:

- Be Insurance Ready. Homeowners insurance named storm (or hurricane) deductibles are typically 2% to 5% of your insured value. For example, if your home has an insured value of $200,000 with a 5% hurricane deductible, you will pay $10,000 out of pocket before insurance coverage takes effect. Details about these deductibles are listed on your policy declarations page.

- Prepare Your Property. Build an emergency kit and consider purchasing materials to board up your windows and make temporary repairs to your home in the event you take on damage. Trim trees around your home and secure loose outdoor items like patio furniture to prevent damage from broken branches and flying debris. Use your phone to take pictures of your property and belongings, including information like brand name and serial number. Having a record of your possessions will make the claims process easier in the event of property damage or loss. The NAIC Home Inventory App makes this easy and is available in the App Store and Google Play.

- Make an Evacuation Plan. Have copies of your insurance policies and your agent’s contact information ready to go in case of an emergency evacuation. This will enable you to start the claims process as soon as possible if your home is damaged in the storm. Learn how to prepare an evacuation route and more at getagameplan.org.

- Filing a Claim. If your insured property is damaged during the storm, contact your insurer first to file a claim. If possible, have your policy number and an initial assessment of the damage ready, and make sure your insurance company knows how to contact you. Take photos of the damage before cleaning up, and don’t throw away damaged items. You have an obligation to mitigate further damage by making temporary repairs like putting a tarp over a damaged roof or boarding up a broken window. Keep your receipts for these expenses.

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.

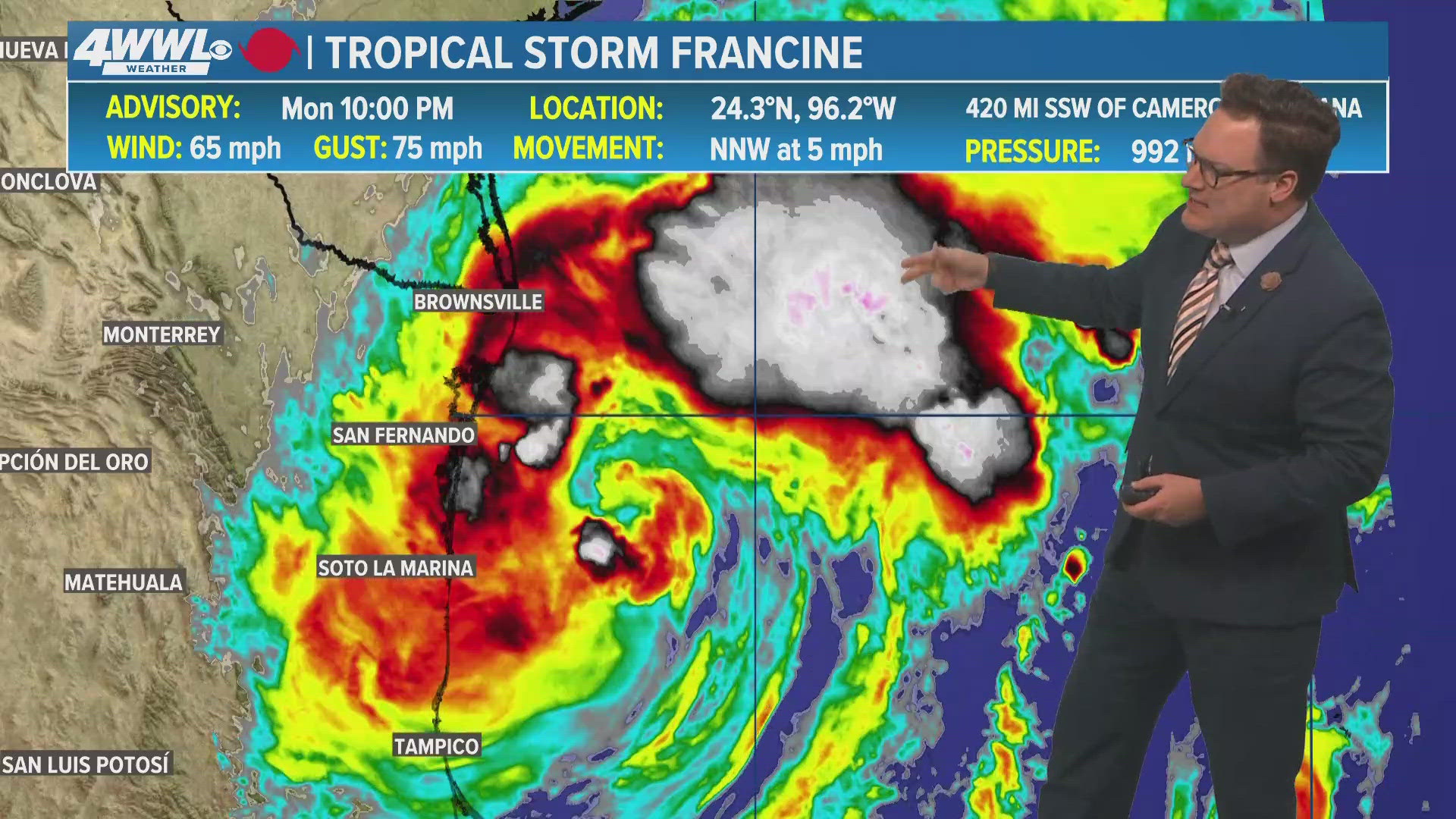

WATCH: Tracking Tropical Storm Francine, possible impact to New Orleans area