Southeast Louisiana has an insurance crisis - the new commissioner says he has some ideas

“It does take time for that to happen — which is why it’s all the more important that we hit the regular session fast and hard with these legislative changes."

Jalence Isles’ boots were nearly submerged by the time she took to Instagram to share what had become a recurring, yet unwelcomed, situation in her Treme neighborhood: flooding from heavy rain made the intersection of St. Ann and N. Rocheblave Streets impassable.

“I am literally wading in the water now. Look at my boots,” Isles said, as she walked in the middle of the street in rising water.

Isles’ video, shared to her Instagram account, called Where Black Nola Eats, generated hundreds of comments from her 39,000 followers. It was one of dozens of videos recorded the night of Feb. 3, after officials from the Sewerage and Water Board said heavy rain, the loss of a power-generating turbine, and clogged catch basins proved too much, too quickly.

Streets swelled, as drivers risked stalling out, and the threat of financial wipeout flooded fears once more. In her Instagram video, Isles expressed the frustration felt by thousands of homeowners throughout southeast Louisiana.

“I can go swimming down my block,” she said, continuing, “Everyone’s insurance is going up like crazy, doubling, tripling, all that kinda stuff.”

Be it everyday rainstorms that overwhelm city pumps, tornados, hurricanes, or fires, Louisiana residents are at a crossroads. For many, it’s a monthly dilemma: keep up with rising insurance rates, or risk it all – in hopes State leaders come up with a fix, soon.

Change comes slowly

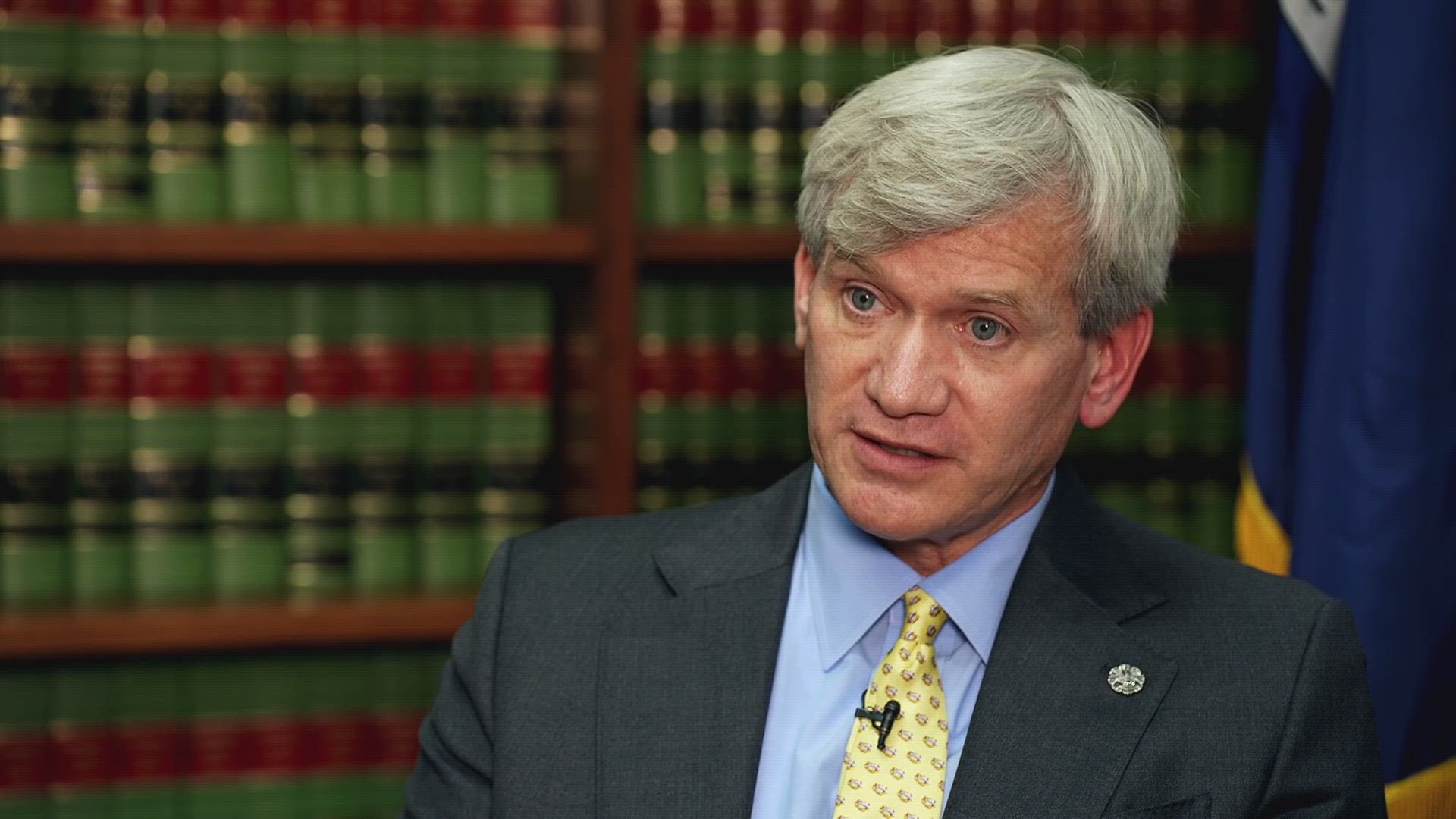

Tim Temple, Louisiana’s newly elected Commissioner of Insurance, said the state’s insurance crisis needs immediate attention.

“I understand that it’s tough. I understand people are making tough financial decisions every day as it relates to insurance,” Temple said.

In an interview with WWL Louisiana, Temple said the state’s insurance crisis did not develop overnight.

The cure, according to Temple, won’t come quickly, either.

“It does take time for that to happen — which is why it’s all the more important that we hit the regular session fast and hard with these legislative changes that we’re going to bring,” Temple said.

The regular legislative session convenes March 11. The session will follow two special sessions on redistricting and crime, respectively. In the weeks after Election Day, Temple pushed for a special session that focused on insurance, however, Gov. Jeff Landry did not call for one. Whatever the reason, rising premiums underscore the problem: after Hurricane Ida, and several other big storms that followed, the deluge became the insurers’ exodus.

“We’ve had twelve companies go insolvent,” Temple said, “but we’ve also had dozens of companies have said, we’re just not going to do business in Louisiana anymore,” he continued.

Temple says his focus is getting more insurers back to the state. He said it’s a task that requires lawmakers to improve conditions for insurance companies to do business in Louisiana.

“Whatever the coverage is we have to attract companies and we attract them by having a predictable stable, regulatory environment,” Temple said.

Temple says less government oversight is the answer to attracting insurance companies to the state, but he says that doesn’t mean less protection for consumers. That protection fizzled for more than a couple hundred thousand policyholders after 12 insurers failed, and others reduced the zip codes for which they wrote policies.

“We’re not going to allow companies to come in – we’re not going to let them take a dollar of your premium with no intent of treating you fairly when you have a claim. That’s the role of the head regulator – is to make sure that the consumer is protected,” he said, circling back to a cornerstone point of the platform: a successful insurance market thrives in a free market.

“In my opinion, it’s to facilitate companies entering the state to do business, doing business in the state, and if they choose to – exit the state.”

But how those companies failed, and why, generates questions about regulation and the role of government in protecting consumers from companies that want to make money.

The Business of Competition

Bottom line, Temple stressed, insurance is a business.

He cited a five-state Gulf Coast competition between Texas, Louisiana, Mississippi, Alabama, and Florida as proof, with each state facing similar insurance challenges, while trying to woo new insurance companies that are willing to write policies.

“If you’re a company looking to write in that area, you’re going to see what’s the regulatory framework. What’s the regulatory environment like in Texas, or Mississippi, or Alabama, or Florida,” Temple said.

One of Temple’s key points of reform zeroes in on a law that’s meant to protect consumers: Louisiana’s three-year rule, a law that prohibits an insurer from dropping a policy, or increasing the deductible, if that policy has been in effect for more than three years.

Non-payment and insurance fraud are two exceptions.

“Louisiana is the only state in the US that has a three-year rule,” Temple said.

The previous insurance commissioner, Jim Donelon, said the three-year rule was needed to protect policyholders.

Temple wants to get rid of it.

“In my opinion, it’s anti-consumer – in the sense that it inhibits companies from wanting to come into Louisiana,” Temple said, adding that he thought the rule was too specific of a requirement for insurance companies. According to Temple, it tells them how and where to spend their money, which, in turn, tells them to stay away. However, a similar bill to weaken the three-year rule failed in the legislature. While Temple did not offer examples of how his pitch to ditch the law would differ, he said the current insurance landscape leaves no other choice.

“Things are not getting better and until we take care of some of the fundamentals… the fundamental insurance challenges that we’ve got in the state, we’re just going to continue to bump along the bottom, if you will, on this affordability issue,” Temple said.

Temple believes insurance companies should be able to provide coverage to storm-prone areas at their discretion, meaning, for example, if a company didn’t want to insure a neighborhood closer to the coastline, it shouldn’t be required to do so.

WWL Louisiana has interviewed multiple homeowners struggling to keep up with rising premiums who have said Temple’s approach is unfair, as they battle high rates, high mortgages, and in some cases, forgo insurance coverage altogether.

“Fair in what sense?” Temple asked. “I mean it’s business. It’s free enterprise. I mean I don’t think it’s a realistic expectation to say that you have to underwrite my home because I choose to live two miles from the Gulf Coast. Or I choose to live on the Gulf Coast,” he continued.

Lawmakers pondered that very question last year in a special session called by then-Governor John Bel Edwards. They approved $42 million in incentive payments – meant to attract new companies by drawing up competition.

It didn’t work, as planned after the industry didn’t get any larger.

“So, it didn’t attract new capital. It didn’t attract new business,” Temple said, adding that he would not support similar legislation proposed on the floor.

However, Temple says a step in the right direction is the Fortify Homes program, which grants up to $10,000 for homeowners to upgrade their roofs – to better withstand hurricane-force winds.

“What I’d like to see is a more permanent, sustainable, funding source for the fortified roof – something more permanent,” he said.

A permanent solution to the problem is the goal; however, Temple said change won’t come easily – nor will it be any time soon – even with the legislature’s support.

“I certainly don’t want to try and set the expectation that this is going to be fixed this year and by the end of the year – everything has gotten better and everybody is seeing, ‘oh, my insurance is so affordable. That’s not a realistic expectation. It does take time for that to happen,” Temple said.

Temple's Experience

Before being elected Insurance Commissioner, Tim Temple spent his career in the insurance industry. He climbed from insurance agent to insurance executive.

He said that experience, from within, is a plus now that his new job in the public sector takes him to the other side of the insurance business.

“I think it’s going to help the consumer at the end of the day because I understand the complexities of insurance,” he said, adding that it’s understanding those complexities that qualify him.

Conflict of interest, he said, is not a worry.

“I know what my mission is. I know what my charge is. And it’s to help foster a competitive marketplace In Louisiana — an affordable marketplace in Louisiana,” Temple said.

WWL Louisiana Anchor Brandon Walker pressed Temple on whether his experience would make him too lenient on insurers, as opposed to advocating for the consumer.

“I think the consumer, at the end of the day, if we’re successful doing what we’re charged with, we’ll let the consumer decide,” Temple responded.

However, with no immediate fix on the horizon, policyholders are struggling to find solutions to lower their premiums now.

“It causes a domino effect,” said Gary Williams, an insurance broker. Williams said after companies failed or left, he had no choice but to send customers to the insurer of last resort: Louisiana Citizens Property Insurance Corporation.

That company saw its policies skyrocket, roughly 247%, from Aug. 2021 to Dec. 2023.

According to data from Louisiana Citizens, the company had a total of 38,309 policies in the month leading up to Hurricane Ida. Two years later, that number climbed to 132,760 policies.

While the rate at which customers flocked to Louisiana Citizens has declined, from its peak of 140,912 policies in Sept. 2023, lawmakers, agents, and customers agree – the goal is to get more customers out – and into policies with more competitive rates.

The state needs more options for that to happen.

Williams said he is seeing more options for customers now, although not many. He said those options depend on several factors: the roof is a big one. Williams also said location matters, as well.

“Depends on their area more than anything. Because there are a lot of companies – even though companies have come back – you’re looking at their eligibilities – if their eligibilities are where you want them to be or not,” Williams said.

For now, according to Williams, consumers’ best bet is to constantly shop around.

He said insurers are beginning to return to areas from which they split after Ida, but consumers must do their homework.

“You have to look at factors – what are their new eligibilities. What are they going to be looking at when it comes down to your home. And will they take that home altogether – due to zip code or area,” Williams said.

Williams understands that’s more of a bandage than a fix. He says lawmakers must act in order for that to happen.

Commissioner Temple agrees.

“We’ve got to tackle this crisis now,” Temple said.

Risky business, both selling insurance and in Temple’s case, securing it.

Consumers find themselves stuck in the middle. They, too, juggle risk, saddled with yet another burden – time.

“They’ve done the right thing. They had a mortgage. They paid their mortgage off. They’re typically people that are in their retirement age and stage in their life and now for a lot of people that’s their latest asset and now it’s going to sit there, unprotected, vulnerable to the next hurricane season that we have,” Temple said.

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.