NEW ORLEANS — Louisiana’s treasurer has joined a growing chorus of voices… coming out against a recent mortgage fee overhaul.

A new rule from the Federal Housing Finance Agency starting this week is changing the fee structure to help lower-income families gain access to mortgages.

The so-called loan-level price adjustment fee – or LLPA fee -- could help those with lower credit scores or little savings by lowering their costs. However, buyers with stronger credit scores could end up paying more.

The fees are charged by Fannie Mae and Freddie Mac to offset their risks, and are rolled into your closing costs.

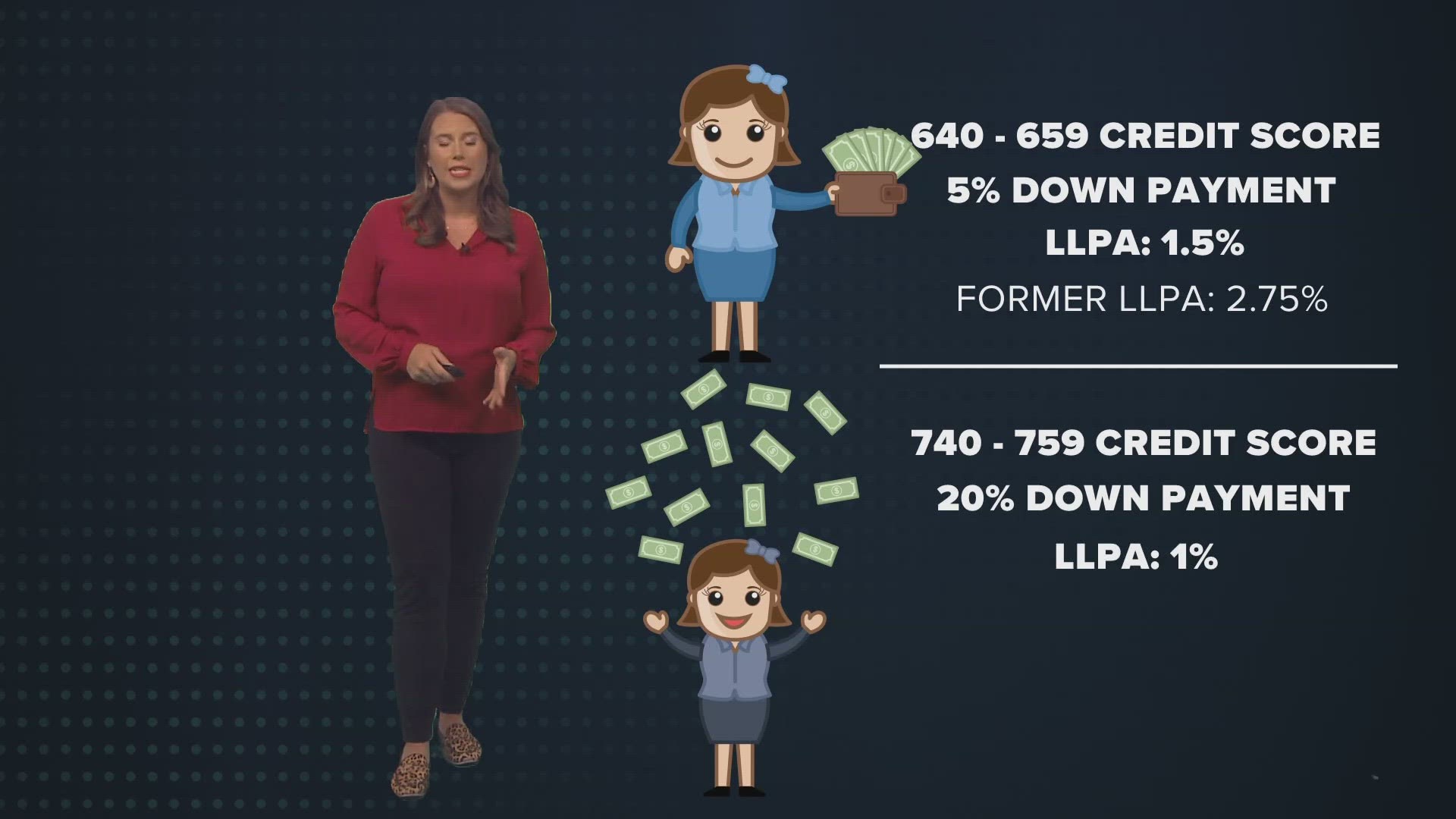

CBS News worked out the math in this example:

A homebuyer with a credit score of 640 to 659 with a 5% down payment would pay an LLPA of 1.5 percent. That charge used to be 2.75%.

In some cases, those with higher credit scores like 740 to 759, who put 20% down, would face an LLPA of one percent. That was 1.5% percent before the change.

The National Association of Realtors and Louisiana State Treasurer John Schroder condemn the policy.

He and 33 other state treasurers and financial officers wrote a letter to the Biden Administration, saying the policy will be a disaster.

They wrote, “The policy will take money away from the people who played by the rules and did things rights – including millions of hardworking, middle-class Americans who built a good credit score and saved enough to make a strong down payment.”

The Federal Housing Finance Agency says those with higher credit scores will still pay lower fees overall, thanks to lower interest rates.

The new rule won’t change your existing mortgage payment.

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.