Hey Louisiana residents, a check is in the mail for many of you.

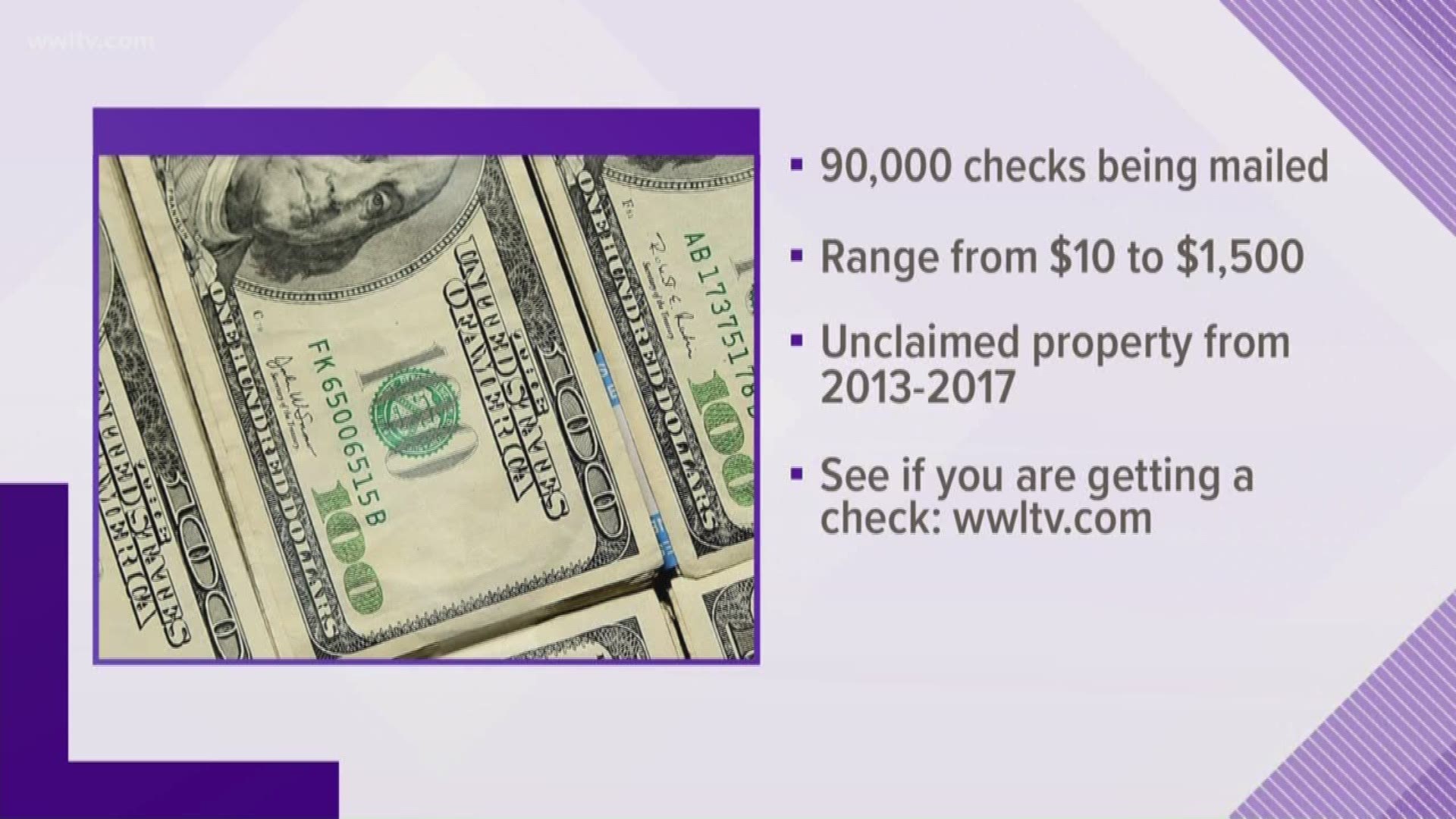

It may not be the Powerball, but 90,000 or more Louisianians will get an early Christmas bonus from the state treasury this fall totaling $20 million.

Treasurer John Schroder said his department began mailing out the checks last week to residents who are owed up to $1,500 and will continue mailing them through November.

"All you have to do to collect this money is open up your mailbox," Schroder said. "You don't have to file a claim form or submit any paperwork. We've done all of the work for you.

"We're excited to be playing Santa Claus," Schroder said in an interview with USA Today Network Monday morning. "We need to get this money back to who it belongs to."

Schroder said he wanted to publicize the mailing to make sure people don't throw away the check when they receive it thinking it's a scam.

The money comes from the unclaimed property ledger managed by the state treasury.

It has always been available to its rightful owners, but until now those making a claim had to fill out paperwork and submit the request, which was to be verified by the treasury.

But a new law authored by Rep. Neil Abramson, D-New Orleans, allowed the Louisiana Department of Revenue to share its database of current and correct addresses with the treasury. Act 339 allowed the treasury to update the addresses it had on file and clear out a backlog of unclaimed property.

"As legislators, our job is to help improve the quality of life for our constituents," Abramson said in a press release. "There is no better way of doing so than returning their own hard-earned money to them."

Businesses from across the country are required to report unclaimed property to the treasury each year and provide the last known address of the owner. Often the address the company has on record is no longer correct. One of the main reasons an item becomes unclaimed property is because of an incorrect or old address.

Schroder said residents who have been matched but are owed more than $1,500 will be contacted by his office to start the claims process in the near future.

"This highlights the importance of keeping your contact information current with the Department of Revenue," said Secretary of Revenue Kimberly Lewis Robinson. "The good news is, it's easy to do. Just visit www.revenue.louisiana.gov/AddressChange."

Though $20 million may sound like a lot of money, it's just a drop in the bucket to what is owed.

Shroder said there is about $900 million in unclaimed property, an amount that grows by $80 million to $90 million each year.

"It just keeps piling up," he said.

Actually, it doesn't. The money isn't kept in a dedicated fund. Instead, it flows into the state's general fund and is spent each year, which means if all $900 million were claimed, the state wouldn't have the money up front.

Schroder said he will again support legislation creating a trust fund for the money as it flows into the state.

A bill to create that fund was passed by the Legislature this year but vetoed by Gov. John Bel Edwards.

The current project covers five years of unclaimed property records from 2013-2017 and includes items where there were Social Security Numbers attached to names. Not all unclaimed property records have Social Security Numbers. Without one, the treasury can't confirm the owner's current address.

"If you don't receive a check, you may still be owed unclaimed money," Schroder said. "We encourage you to visit www.latreasury.com to conduct a search."