GREENSBORO, NC – The “company” sent you a check. It looks real. The bank cashed it. And then…..

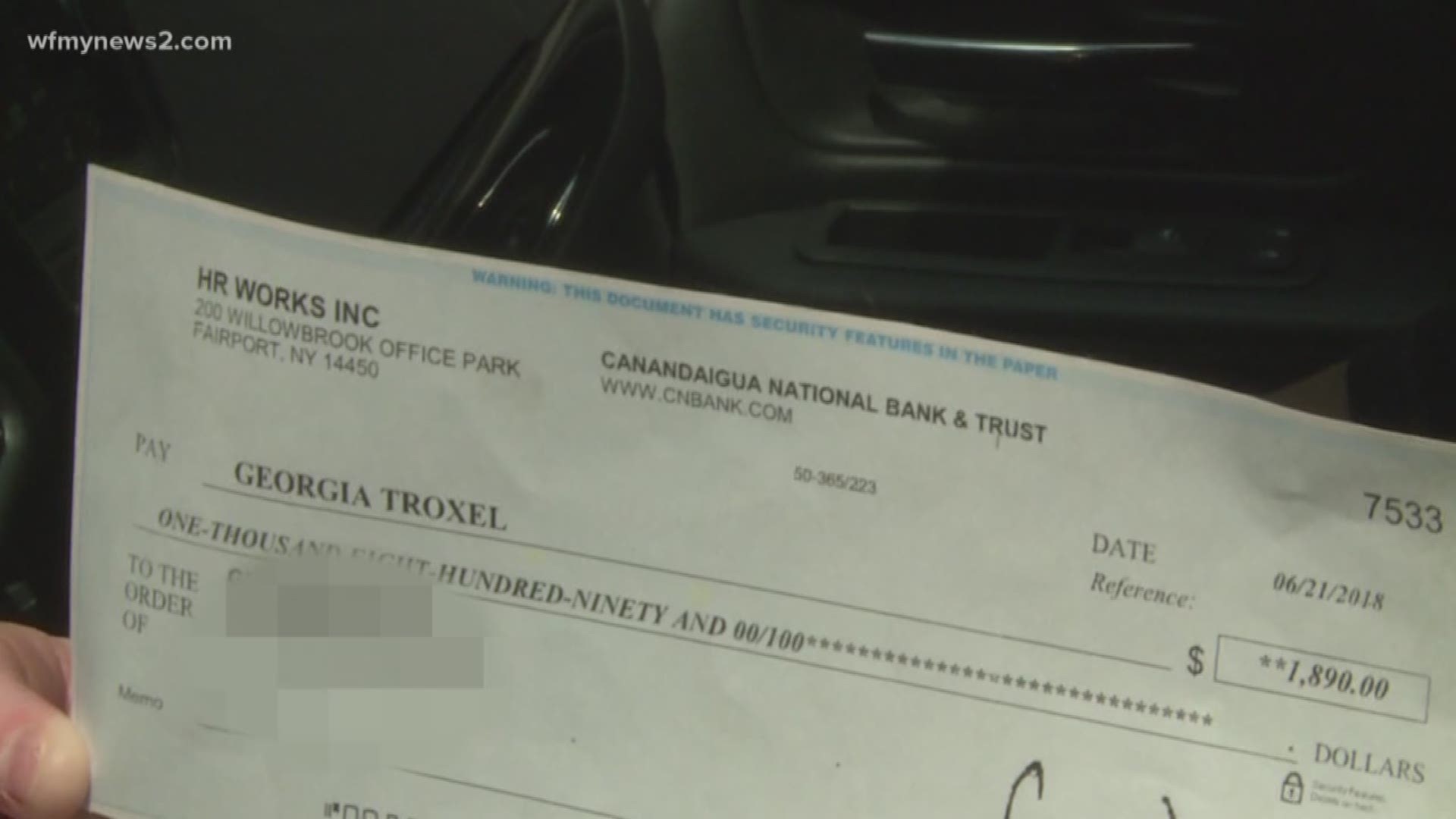

“The crooks steal real checks from businesses and other organizations, scan and photoshop them, and then send them to victims. So that's why the banks take them and cash them. And then hold the customer responsible,” explains the Better Business Bureau’s Lechelle Yates.

Georgia Troxel got one of those check. ”They sent me a thing saying they were going to send me a check by FedEx and I was to cash that check and keep $400 and send the remainder to a place in Texas.”

It sounded like easy money. And it all started with a text asking her to wrap her car with an advertisement. She would get $400 bucks a month.

But the job and the check weren't real.

“This is wrong. You're taking advantage of people who don't need to be losing that kind of money.” Georgia is right. No one needs to be losing that kind of money. She was one of the lucky ones to know it was a scam and

she called the Better Business Bureau.

The BBB has the anatomy of a fake check. Check out the picture here. Also, know this: just because a bank cashes a check and the money gets credited to your account does not mean the check is good. Federal banking rules require a bank to make the funds available when you deposit a check.

But it can take up to a week for your bank to figure out there's no money in that account. So then when the check bounces you're on the hook for the money. But a lot of checks used in fake check schemes are cashier checks and money orders.

“I didn't think those could be faked.”

That's what a lot of people think. That's why scammers use them. Many of us think that a cashier's check or money orders are the same as cash. But they can be forged.

Common fake check scams:

- Mystery shopping is another big one – you get check – some for your services, you’re supposed to use the rest to test out the western union services at Walmart.

- People who get hired for work at home jobs get fake checks to send money for a laptop or software to third party.

- Fraudsters behind some of the publisher’s clearinghouse scams are now sending fake checks to cover “taxes” owed before the prize can be delivered.