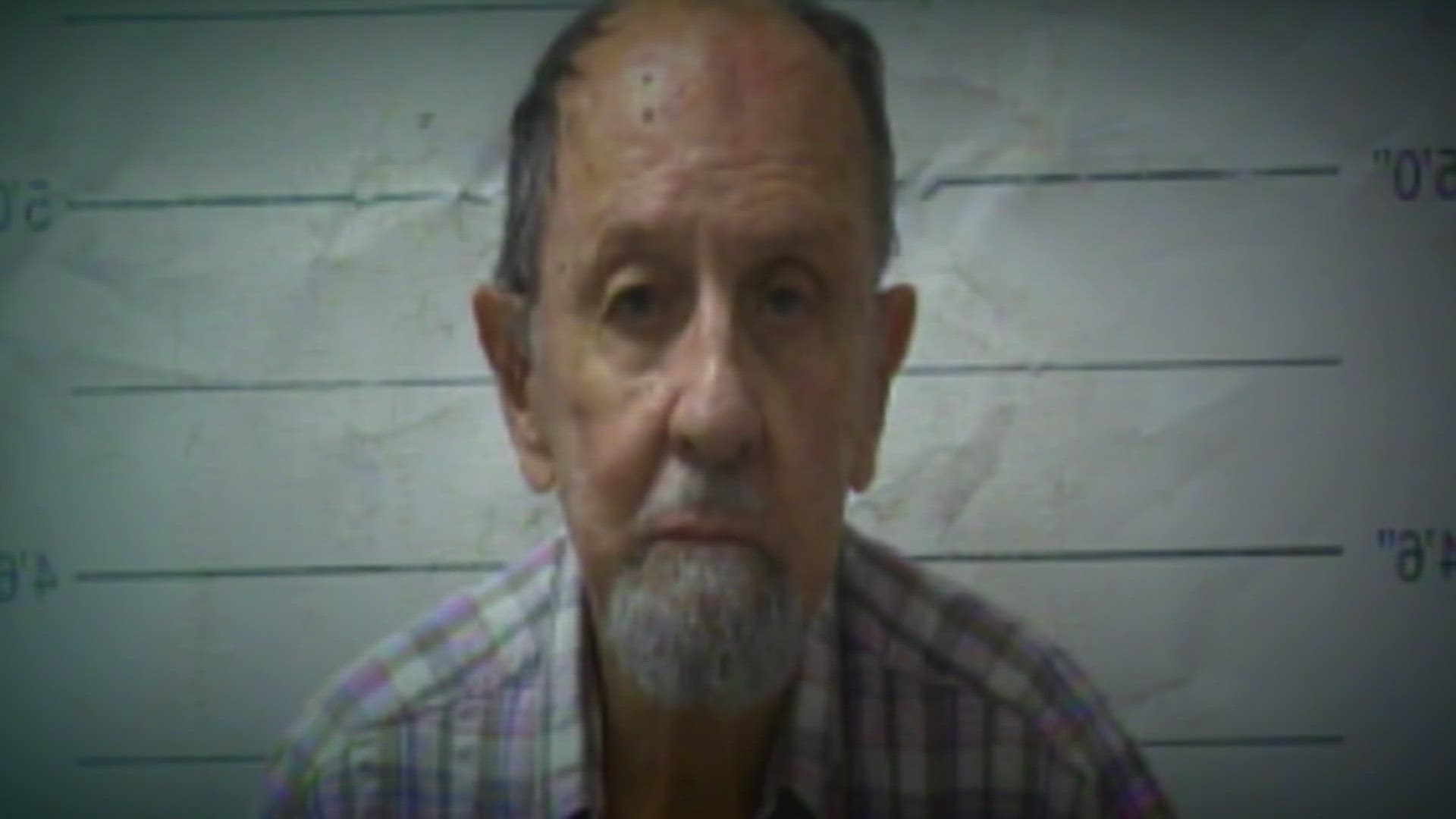

The leading private building inspector in the New Orleans area has been implicated -- but not charged -- in an alleged half-million-dollar tax fraud scheme less than two weeks after he was arrested in Jefferson Parish for allegedly falsifying a home inspection.

In a federal grand jury indictment handed up Friday, prosecutors do not charge Randy Farrell with a crime, but they make it clear they believe he played a key role in setting up fraudulent payments to avoid taxes.

Farrell has been in the news lately as the owner of IECI & Associates, the primary company hired by city and parish governments to help them with building safety inspections.

But Friday’s indictment involves two other Farrell-owned companies. Prosecutors lay out an alleged conspiracy involving Farrell’s brother, sister and former business partner, and allege that “Person-1” is also involved. The indictment identifies “Person-1” as someone who co-owned SES Construction Consulting Group and Global Technical Solutions until 2015 and is the sole owner of those companies now.

Louisiana Secretary of State corporate records indicate that person could only be Randy Farrell.

The U.S. Attorney’s Office and the Internal Revenue Service announced the nine-count indictment Friday against Farrell’s brother, David Farrell of Metairie; their sister, Dawn Farrell Ruiz of Covington; and Randy Farrell’s former business partner, Mathew Reck of Covington.

All three are charged with conspiracy to defraud the IRS. The grand jury also charged Reck with making false statements to federal investigators, charged David Farrell with filing false tax returns and charged Ruiz of assisting in the preparation of fraudulent tax returns.

Here's how the indictment lays out the alleged tax fraud conspiracy:

Between 2011 and 2015, Reck co-owned SES and Global Technical Solutions with Randy Farrell while Ruiz and David Farrell worked for both companies. The indictment alleges they all worked together to underreport their personal income and to hide payroll expenses to avoid paying taxes.

The indictment lays out 96 payroll payments it describes as “off-the-books” or “under-the-table cash payments” totaling nearly $500,000. It says “Person-1” signed off on 45 of the 96 payments.

The indictment says Ruiz handled bookkeeping for the two companies and alleges she hid more than $100,000 in payments to her and her husband, who is referred to as “Person-2” in court documents.

The indictment says “Person-2” is Ruiz’s husband and also co-owns a separate company with her called RDR Management. Secretary of State records show her husband, Ricardo Ruiz, is co-owner of RDR Management.

The indictment alleges some of Global Technical Solutions’ payments to employees were routed through RDR so GTS wouldn’t have to pay the payroll taxes. For instance, the indictment alleges a $150,000 check to RDR was then used to pay Reck.

Prosecutors also alleged that some of David Farrell’s compensation was disguised as subcontractor payments to a separate company he owns, Shark Pool Service, so it wouldn’t be subject to payroll taxes.

The indictment also details some emails that allegedly show Reck and Randy Farrell communicating with an accountant who has since died, with Reck allegedly pushing the accountant to understate their personal income on tax returns.

Prosecutors allege Reck emailed the unnamed accountant in 2013 and told him to make sure to report as little partnership income for him and Randy Farrell as possible. When the accountant confirmed he had written off everything that “wasn’t nailed down to the floor and even some of that” to minimize their income, the indictment alleges Randy Farrell emailed Reck saying of the accountant, “He’s a freaking Houdini!”

WWL-TV has done a series of stories about the largely unregulated system of private construction safety inspections dominated by another Randy Farrell company, IECI.

In a separate criminal case two weeks ago, Jefferson Parish Sheriff’s deputies arrested Randy Farrell and one of his IECI inspectors, former New Orleans city building official Larry Chan. They were booked on charges of filing false statements into official government records, obstruction of justice and accessory to contractor fraud, for allegedly falsifying inspections at a home renovation project in Metairie.

In an interview with WWL-TV before turning themselves in March 18, Farrell and Chan denied any wrongdoing in the inspection fraud case. They were then booked and released on bond.

When WWL-TV reached Randy Farrell on Monday to ask about the federal indictment against his brother, sister and business partner, he said: “Because my comments were misquoted or taken out of context to create a story, I will not comment further.”

He would not specify what he felt was misquoted or taken out of context.

As for the defendants in the federal tax fraud case, when WWL-TV reached Dawn Farrell Ruiz by phone Monday, she said, “You don’t know how to report stories, obviously, so I have nothing to say” and hung up.

When this reporter called David Farrell and identified himself, the person who answered immediately hung up.

Reck has not responded to a voicemail message Monday afternoon seeking comment.

No attorneys have enrolled as of Tuesday morning to defend any of those three defendants in the federal tax fraud case. Their first appearance in court is scheduled for April 9.