N.O. ‘investor’ tricked people out of their homes, lawsuits allege

There have been at least 7 lawsuits filed against Jonathan Burden, claiming he preys on distressed homeowners.

A tough decision at life's worst moment

Kathryn Stewart’s stately Garden District home was facing foreclosure last October, and the 63-year-old widow said she was conflicted.

“I’ve been here 40 years. I mean, I raised my kids here. My husband died here,” she said.

But there was no way around it. She had to sell it because her late husband, Earl Stewart Jr., had taken out a reverse mortgage in 2013 to borrow money from the million-dollar home’s value to cover rising medical expenses. When he died in 2019, she was left owning the massive house, as well as a debt of almost $400,000.

A family from Texas offered to pay her $1.1 million for the home, plenty to pay off her debts. But now, Stewart was in the empty house, talking to a man she’d never met before – a self-described “real estate investor” and “credit repair agent” named Jonathan Burden.

What came out of that meeting – nearly five hours of gut-wrenching discussion with a complete stranger – is the subject of one of at least seven lawsuits filed against Burden in recent years, alleging he preys on “distressed” homeowners.

The lawsuits claim Burden engages in “fraudulent, unlawful and deceptive actions” and gets property owners to either pay him for services he never provides or to sign their properties over to him for little or no payment.

'Investor' had found trouble before

Burden was also sanctioned in 2020 and banned from providing debt-relief services or bankruptcy assistance after the U.S. Bankruptcy Trustee found he and his agents had advised at least 11 different property owners to file for bankruptcy and filed their petitions with the court without the required law license.

But none of it seems to deter him. He has avoided service on some of the lawsuits and boldly calls the police to get people to leave properties they allege he stole out from under them. Burden is so proud of his “hustle” he went on a video podcast called “The Note Closers Show” in 2019 to describe in detail how he knocks on doors looking for sellers, often late at night.

“I get a decision made, kind of like right then and there, like, 'Okay, you wanna sell this thing? Do you want to stay? Tell me what's going on.' And I kind of find out like everything that's going on,” he told the show’s Texas-based host, Scott Carson. “So, if they tell me that they want to stay, I'll provide like a short-term loan for them so they can not be faced with the foreclosure. And I take the deed for that. That's my collateral if they ever missed the payments or whatever.”

Burden also posts many of his real estate conquests on social media. He narrates videos as he prepares to knock on doors at houses slated for the auction block or facing large tax delinquencies. He records himself speaking to owners in their homes or cars, assuring them “some superheroes just showed up, and you got a great benefit,” often showing them signing contracts with him on the spot.

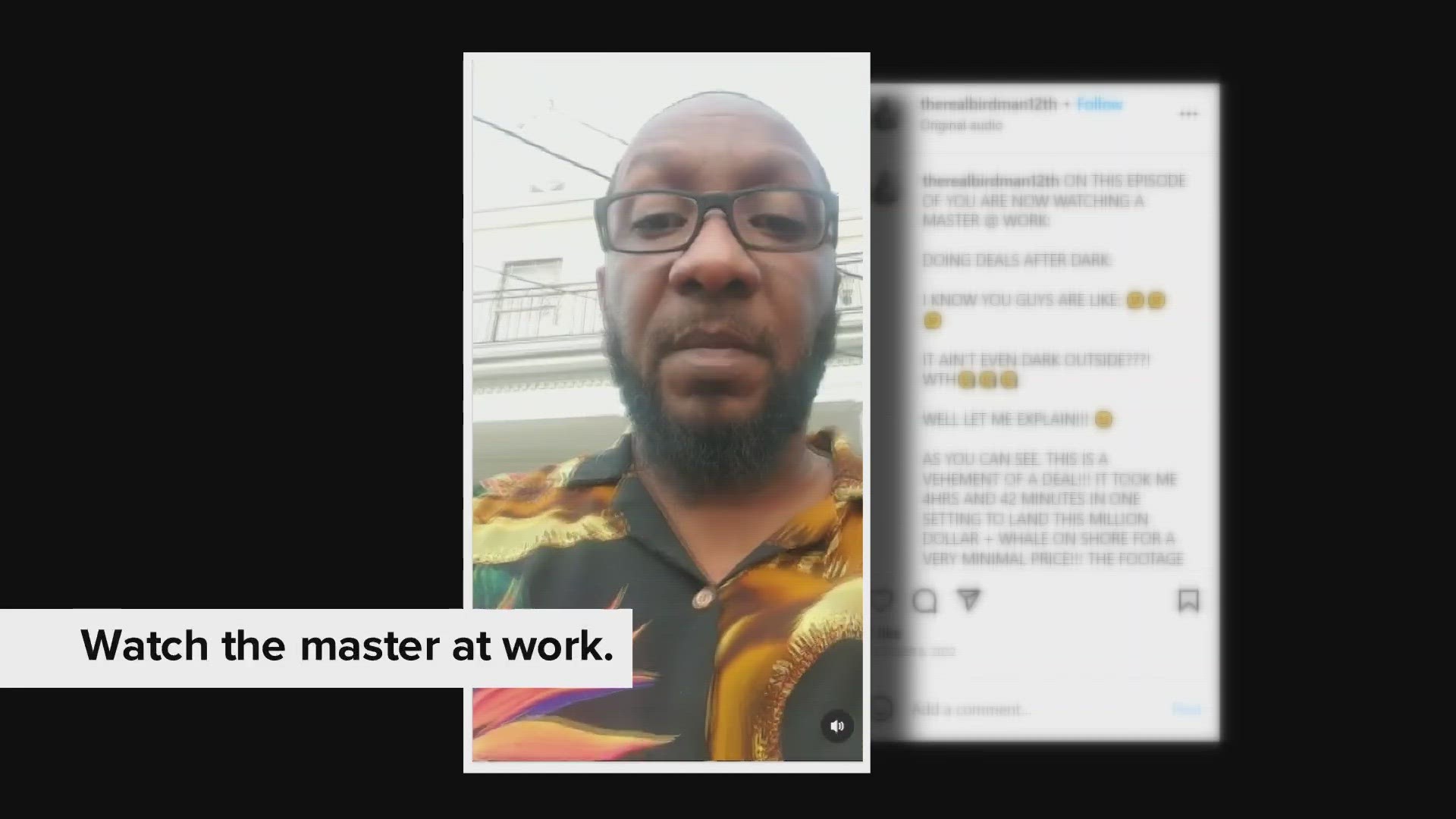

'Watch the Master at work'

But in his Instagram posts accompanying the videos, Burden brags about the money he makes. As he walked up to Stewart’s house on October 4, he looked into the video camera on his phone and said, “That monster I’m about to take down…. Watch the master at work.” Two days later, he posted the video on Instagram with the caption: “It took me 4 hrs and 42 minutes in one setting to land this million dollar + whale on shore for a very minimal price!!!”

According to documents Stewart filed in a lawsuit against the Orleans Parish Clerk’s Office and Burden’s company 504 Title LLC, Burden had texted Stewart on October 3, the day before he showed up at her house, saying he wanted to make a “backup offer” for the house or provide her with a loan to stop the impending foreclosure.

In the videos, he tells Stewart the first buyers “ain’t gonna perform,” but he would, and he’d make sure she walked away with at least $200,000.

“Let me take that burden off your hands,” Burden said in the video posted on Instagram.

Stewart alleges in the lawsuit that she signed two documents which purported to give Burden an option to buy the house for the next 30 years. Based on his text, she thought it was just in case the $1.1 million deal fell through. But Burden filed the documents in the Orleans Parish Land Records, clouding the title and essentially holding the sale hostage.

Burden negotiated to get $85,000 from the sale proceeds so the deal with the Texas buyers could go through and Stewart could avoid foreclosure.

“He walks away with $85,000, putting up not a penny and misleading Ms. Stewart and making a lot of false promises,” said Stewart’s attorney, Sal Bivalacqua, who also represented another property owner in a case against Burden.

Despite setbacks 'investor' won't stop

Both times, a judge ruled the transfers to Burden should be stricken from the land records. But that hasn’t stopped Burden. Just this week, a new lawsuit was filed against him and his company, Three Four Five Investment Group, alleging Burden filed documents to take ownership of a property from a woman after her death.

That lawsuit was filed in U.S. Bankruptcy Court by Johnnie Robinson, the sole heir of his sister Lorraine Robinson’s distinctive yellow house with dark brown trim in Central City. Johnnie took care of Lorraine after she had a stroke and heart attack in 2017. He hired bankruptcy attorney Jonathan DeTrinis in 2020 to file for bankruptcy protection and save the home Lorraine had owned for 30 years.

They were able to save her home, which included her apartment and three others rented out to tenants. Only after Lorraine died in January of this year did Burden file a purchase contract and a quitclaim deed in the city land records, claiming she had signed the house over to him back in December 2019.

David Alfortish, an attorney who handled a succession case on a property on the same block that led to another transfer to Burden, said he was handling that succession case when Burden invited him into Lorraine’s home to notarize her signatures. Alfortish said he never asked to see her identification and didn’t know why her name was signed “Lorange.” But he said it wasn’t his responsibility as a notary to determine if she was competent.

“I might have notarized 10 different papers for (Burden) and then I realized I better back out of this before I get into, well, the situation I’m in now,” Alfortish said.

Johnnie Robinson said his sister never mentioned meeting Burden or signing any documents, even while they went through the bankruptcy proceedings and paid DeTrinis to save the house from foreclosure.

“And it just didn't make sense to me,” DeTrinis said. “Why would Lorraine give up ownership interest in her property, then spend three years paying back mortgages and debts on the property only to have it taken by someone for nothing?”

Johnnie Robinson said he only learned about Burden when he heard from the tenants that he had shown up to collect the rent.

Burden called the police to get rid of Robinson twice, alleging he was the interloper trying to collect rent from Burden’s tenants. Although he didn’t file the transfer documents until February 2023, Burden had the Assessor’s Office record him as the rightful owner of the house since December 2019. The assessor’s public database shows that’s when Lorraine Robinson transferred the property to Burden for $0.

Burden filmed the police confronting Johnnie Robinson and posted the videos on Instagram. In both cases, police officers can be heard referring to the assessor’s database and ordering Johnnie Robinson to leave as Burden gloats.

At least four other homeowners who faced foreclosures in New Orleans and Jefferson Parish also have sued Burden. Cheryl Robertson and Joan Sunseri each allege they paid Burden hundreds of dollars a month for mortgage foreclosure relief.

In Sunseri’s case, she alleges Burden provided no services in exchange for $14,000 in payments. Robertson alleges Burden and his associates took her to a notary to save her home and had her sign a blank signature page, never explaining that she was handing her property over to a woman who had paid off Robertson’s $11,000 mortgage note.

“They had her sign multiple things and just said they needed it to save her house,” said Robertson’s attorney, Julia Jack. “They used other pages to conceal the word’s ‘quitclaim deed’ so it didn’t dawn on her until later that she’d signed the property over to someone.”

WWL-TV tried repeatedly over the last week to reach Burden, leaving phone, email, and text messages with him and some of his attorneys. He didn’t respond. But he did defend his methods on the “Note Closers Show” podcast. He said he often had a woman he called his “student” knock on doors while he stood behind her “because … when they see a female, their guards go down.”

He said his “student” started crying after joining him on his door-knocking rounds, so he said this to reassure her:

“We're not taking advantage of anybody. We're here to help provide good help, because if not, they'll drown and they're going to lose the property or whatever the case may be.”

On the "Note Closers Show" in 2019, Burden said he was working as a credit repair agent for a company called Financial Education Services. Last year, the Federal Trade Commission shut down Financial Education Services for preying on the poor by taking their money for empty services in what the FTC called a "credit repair pyramid scheme."

On the podcast, Burden said attorney David Birdsong helps him create loan documents and other legal paperwork. Birdsong, a title attorney at Gulf South Title in Metairie, said he's closed several real estate deals for Burden, and occasionally answers legal questions for him, but added, "I would not characterize myself as his attorney in an ongoing relationship."

In 2020, the U.S. Bankruptcy Trustee for the Eastern District of Louisiana, a Justice Department official, opened an investigation and found Burden improperly filed bankruptcy petitions for at least 11 different homeowners, even though "neither Mr. Burden nor his agents are licensed attorneys."

The bankruptcy court responded by banning Burden from offering any more debt-relief services or bankruptcy assistance and sanctioning him. Still, he continues to file documents in the land records, which the Orleans Parish Clerk’s Office says it is duty-bound to accept, even with the sales amounts blacked out.

“Stop him. Maybe even put him in jail,” Johnnie Robinson said. “Because, you know, they hurting people out here, man.”

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.