NEW ORLEANS — An outside expert brought in to help resolve the Roman Catholic Archdiocese of New Orleans’ expensive, highly contentious bankruptcy protection case has suggested deferring pay to all professionals involved in the matter for three months.

The move is to see if that prompts the church and clergy abuse victims to compromise on conflicting settlement proposals which are hundreds of millions of dollars apart.

If the two sides fail to reach an agreement during that period, bankruptcy restructuring professional Mohsin “Mo” Meghji has advised the judge in charge of the case to have a special examiner investigate all of the archdiocese’s assets – including cash and real estate – and whether the church filed for Chapter 11 protection “in good faith.”

Costs in the bankruptcy have soared above $40 million, well over the $7.5M that the archdiocese initially estimated it would take to resolve the case shortly before filing it in 2020.

It wasn’t immediately clear whether the US bankruptcy court judge, Meredith Grabill, would adopt Meghji’s advice, contained in a 35-page report released late Wednesday. Grabill paid $350,000 from the archdiocese’s estate for Meghji, his M3 Partners and their frequent collaborators at the Latham & Watkins law firm to produce.

Grabill appointed Meghji, who is based in New York City, on 21 August to assess the viability of two competing church restructuring plans drafted by the archdiocese as well as those to whom it is indebted, among them hundreds of victims of sexually abusive archdiocesan clergymen and other personnel.

*Story continues below image

Church bankruptcy attorneys are proposing to settle the case by paying about $125,000 – none from insurers – to each of more than 500 people claiming to have survived clergy abuse. In turn, the clergy abuse claimants are demanding about $2m each, the bulk of which would come from the church’s insurers.

Recent bankruptcy cases involving Catholic dioceses elsewhere cost church officials in Los Angeles about $650,000 per abuse claim and roughly $609,000 on New York’s Long Island. Respectively, those bankruptcies involved about 1,300 abuse claimants and 600 abuse claimants.

Meghji’s report describes his belief that both sides are “capable of reaching a resolution through a broadly consensual, confirmed plan of reorganization”.

That plan should pay survivors from cash and other assets from the archdiocese as well as its affiliated institutions while leaving them all enough “to reasonably continue their core operations”, the report said. It should also have space for “non-monetary relief,” including more robust and effective safeguards continuing to aim to prevent sexual abuse from occurring in the archdiocese.

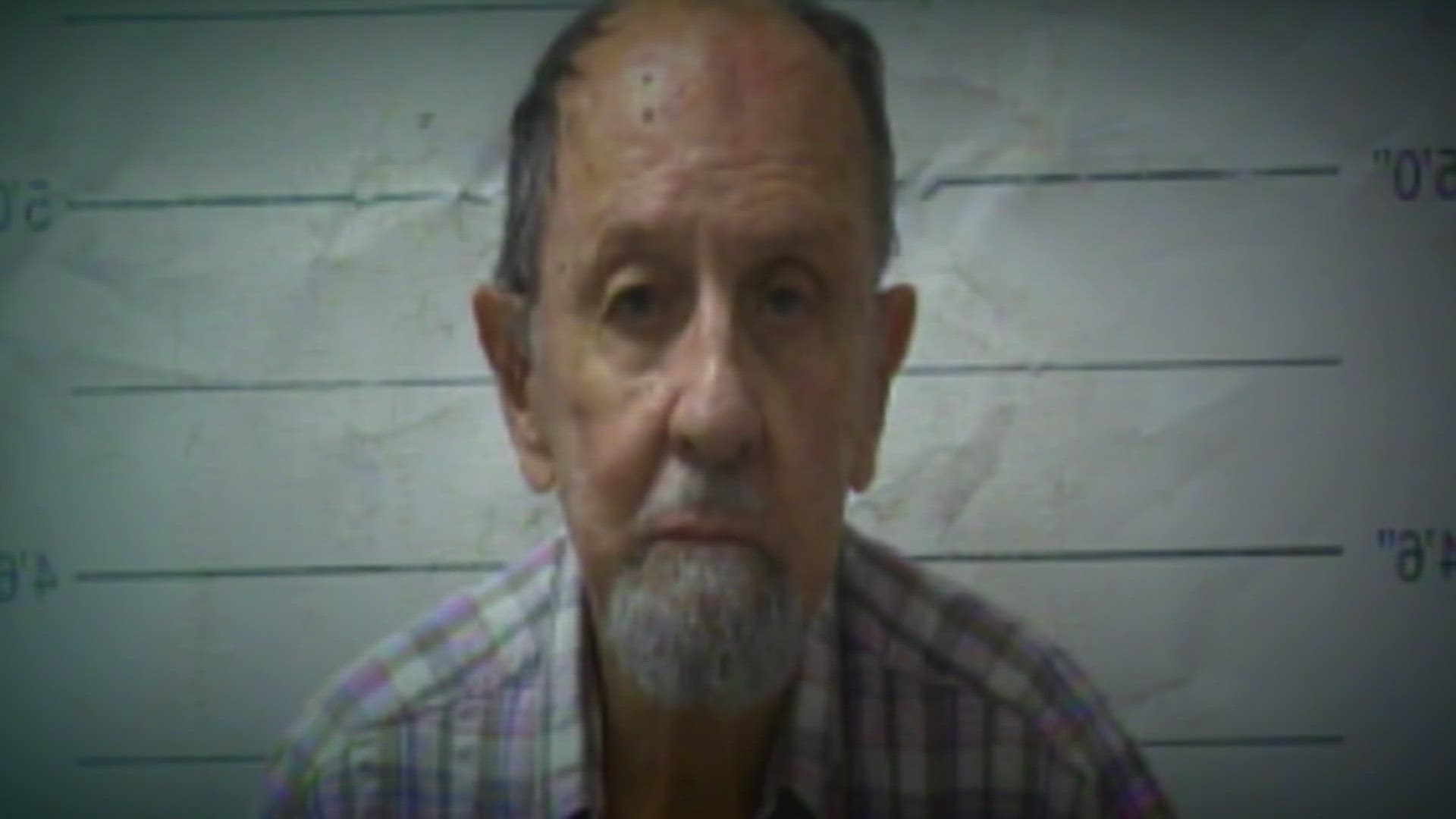

Grabill had asked Meghji to assess the archdiocese’s current management structure and practices after the Guardian and its reporting partner WWL Louisiana revealed that the New Orleans archbishop’s hand-selected corporate representative in the bankruptcy – Lee Eagan – had testified in legal depositions that he had no relevant expertise for the role he had been given.

Eagan also testified in legal depositions that he had grappled with cognitive decline after a car crash a little more than two years into a bankruptcy which has largely paid out fees to the archdiocese’s own attorneys and their advisers so far.

*Story continues below image

Prior to the release of Wednesday’s report, the archdiocese’s attorneys had argued that it would violate the separation of church and state called for by the US Constitution for Grabill to wrest away control of the organization’s finances from the New Orleans archbishop, Gregory Aymond.

Meghji’s report said his team interviewed Eagan and Aymond during hundreds of hours of video conference meetings and in-person interviews with stakeholders. “Although competent, Mr Eagan has not yet been able to provide the leadership necessary to guide the Chapter 11 case to conclusion,” the report said.

The report said Eagan indeed is “not a restructuring professional and may not be fully aware of all of the … tools available to push parties to a deal”. But the report said the church’s attorneys and advisers should provide him with the necessary guidance.

New Orleans Catholic clergy abuse claimants and their attorneys were unsure what to expect from Wednesday’s report.

The Wall Street Journal reported earlier in October that Meghji was facing scrutiny from the FBI after his conduct in a separate case raised ethics-related questions.

As the Journal tells it, citing sources, Meghji caught FBI agents’ attention after hosting a 2022 banquet at one of the priciest restaurants in Manhattan that listed thenbankruptcy Judge David Jones as a guest of honor. Experts say hosting such a social gathering is at best unethical because it signals to potential clients a special relationship with a judge.

Meghji later steered a California biotech client’s Chapter 11 bankruptcy case to Jones’s courtroom in Houston – where the company had never done business – in conjunction with various attorneys.

While earning $225,000 monthly for his work on the case, Meghji soon successfully urged Jones to authorize the biotech company, Sorrento Therapeutics, to borrow $30m to pay employees and professional advisers. Sorrento’s shareholders objected to the loan’s expensive terms to no avail.

Jones resigned as a bankruptcy judge in October 2023 – and has been under the FBI’s microscope – after a lawsuit revealed his romantic relationship with an attorney who had worked on Sorrento’s Chapter 11 filing. The lawyer, Elizabeth Freeman, had also worked on other cases that had been before Jones.

*Story continues below image

The Journal reported that the FBI had recently sought information about Meghji as well as certain attorneys amid an investigation into whether bankruptcy professionals had coordinated with Jones in a manner that interfered with the fair administration of Chapter 11 cases in his courtroom.

Grabill chose Meghji over a New Orleans-based business restructuring expert who expressed interest in the role. The local expert had a godson who was a priest within the New Orleans archdiocese. And Grabill said she preferred Meghji as someone coming from outside New Orleans’ city limits and for the acclaim he had previously won leading restructurings at Sears, Barneys and Vice Media.

“I’m willing to spend a little bit of money to reinvigorate – or instill for the first time – confidence in this process,” Grabill said in court as she brought Meghji into the New Orleans church bankruptcy’s fold. “This is our shot. We’re going to take it.”

But how much of an outsider Meghji truly was had been questioned by certain parties in the church's bankruptcy. A publicly available transcript shows Grabill spoke with Jones before she decided to remove four clergy abuse victims from a committee representing the interests of survivors involved in the New Orleans church bankruptcy in 2022 because their attorney alerted a local Catholic high school that a priest stationed there had admitted molesting a teenage girl during a previous assignment.

Grabill also fined the attorney $400,000, maintaining his actions violated a confidentiality order applying to certain church information after the archdiocese filed for bankruptcy.

Some tracking Meghji’s roles in the Sorrento case and the New Orleans church bankruptcy noted how it was ironic that someone who had drawn law enforcement interest was reviewing the finances of an archdiocese which itself was being investigated by authorities.

*Story continues below image

In April, at least one FBI agent accompanied Louisiana state police troopers as they served a search warrant on the New Orleans archdiocese amid an investigation into whether the institution’s leadership had run a child sex-trafficking ring responsible for “widespread sexual abuse of minors dating back decades” that was “covered up and not reported to law enforcement”, according to criminal court documents filed under oath.

Meghji and his team wrote in their report that “more than one participant” in the case indicated “that this was the most adversarial proceeding they had ever experienced in their careers”, attributing that to various reasons.

He made it a point to express his sympathies for clergy abuse claimants.

“One thing is certain – the survivors deserve better,” Meghji’s report said. “This is one of the primary reasons the next 90 days in the Chapter 11 case are critical.”

The archdiocese didn’t immediately comment on Meghji’s report.

A statement from an attorney for various clergy abuse claimants, Soren Gisleson, said Meghji’s report “may be the pressure needed to force the archbishop to finally take the ... survivors seriously,” though he added that Aymond “may continue to make the same mistakes until his role in the bankruptcy ends”.

Gisleson’s statement also said that he and his associates would “look forward to deposing Mr Meghji and his team soon” about certain statements they made in their report about survivors and their counsel.

Losing Faith: Church bankruptcy fees hit $40M

.