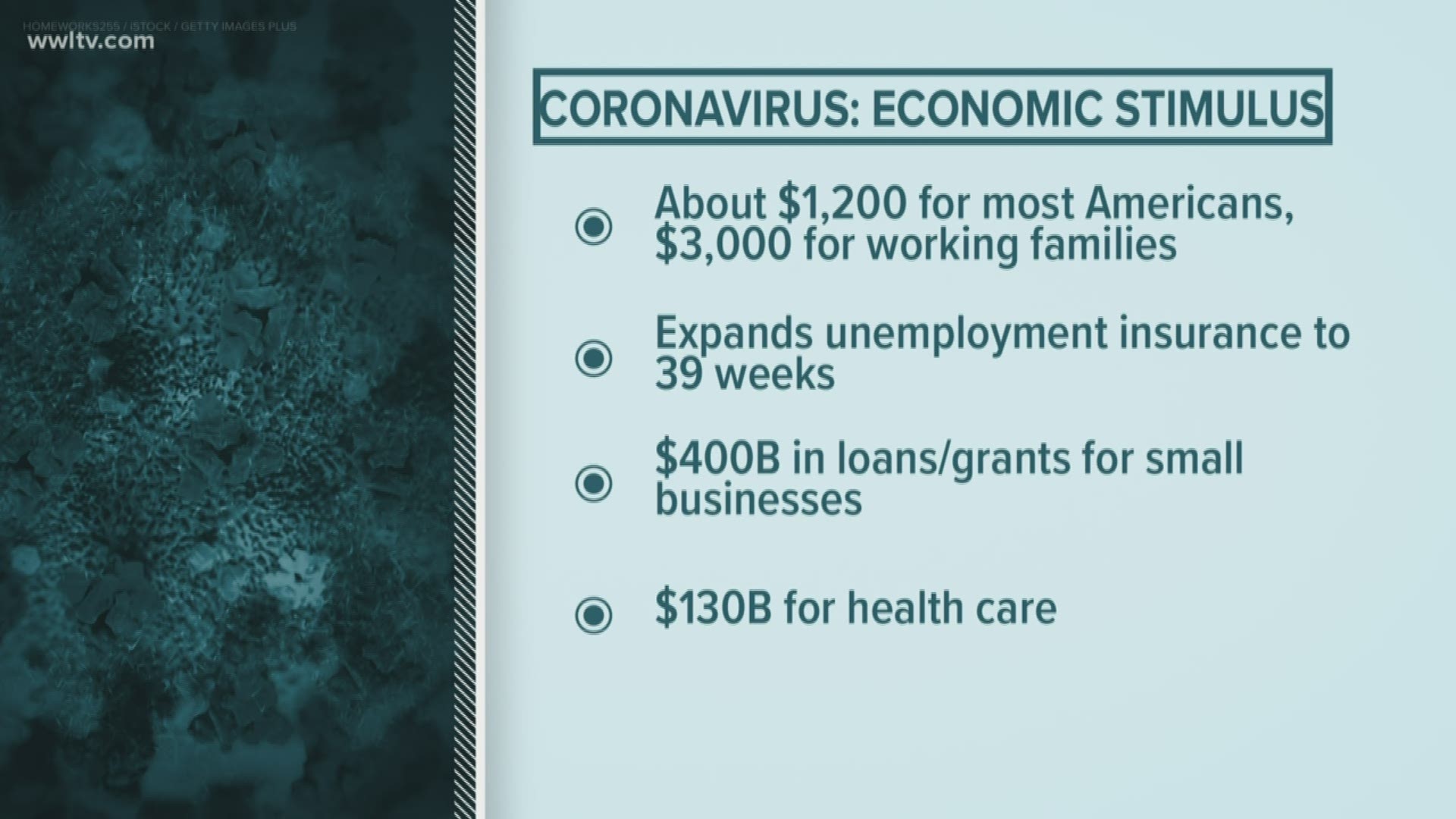

NEW ORLEANS — Congress has reached a deal and is expected to soon approve a $2 trillion coronavirus rescue bill.

It would give direct payments to most Americans and expand unemployment benefits.

The bill also provides billions of dollars for small businesses to keep making payroll while workers are forced to stay home.

GNO, Inc CEO Michael Hecht spoke with WWL-TV reporter Paul Murphy about the rescue package and how businesses can take advantage of the program.

Murphy: How does the payroll protection plan work?

Hecht: These are basically going to be forgivable loans for business expenses, for payroll and rent and utilities, and the portion that you use for payroll, rent and utilities —up to 8 weeks of it will be forgivable, converted into a grant.

Bottom line is by using this program, you should be able to cover two months of basic operating expenses and hold on to most of your employees.

Murphy: How do you apply for a disaster loan/grant?

Hecht: I would just call it the Small Business Forgivable Loan Program.

So, you’re going to go to the bank that you already go to — that already knows you, has your information where you have a checking account, and they’re going to process the loan for you and do it quickly, we believe.

Murphy: Does the loan/grant cover both payroll and benefits such as insurance contributions?

Hecht: Forgiveness of the loan is expected to allow for the total of expenditures that the lender reasonably expects the borrower to expend for payroll and benefit costs, interest on existing debt, rent, and utilities. Payroll and benefits include group health benefits and insurance premiums.

Murphy: Would the program cover employees who were already laid off?

Hecht: I believe — and I don’t know the exact details, but employees that you have laid off, you could also bring them back. Then they can be covered as well.

Murphy: When is this loan/grant program expected to be up and running?

Hecht: What we hope happens it gets signed by the Senate (on Wednesday). We hope that the House then agrees to it via a unanimous consent, so it goes to the president’s desk. Then there’s going to be some period of time of getting the banks ready and writing the rules. Hopefully, this will be quick., Hopefully, this will be a matter of a few days and then we start seeing the cash at the ground.

Murphy: What is your sense of the New Orleans economy as families and businesses suffer financial hardships from the Coronavirus outbreak?

Hecht: The bad news is that of course there is significant damage being wrought. First, on the human scale, it’s an intimate town, and I think everybody knows somebody who is sick or worse. Then economically, we are seeing tens of thousands of layoffs, particularly in the hospitality industry. There’s no place in America, practically and emotionally equipped for this, than Greater New Orleans. This isn’t our first rodeo. It’s just a different bull.

More stories:

► Get breaking news from your neighborhood delivered directly to you by downloading the FREE WWL-TV News app now in the IOS App Store or Google Play.