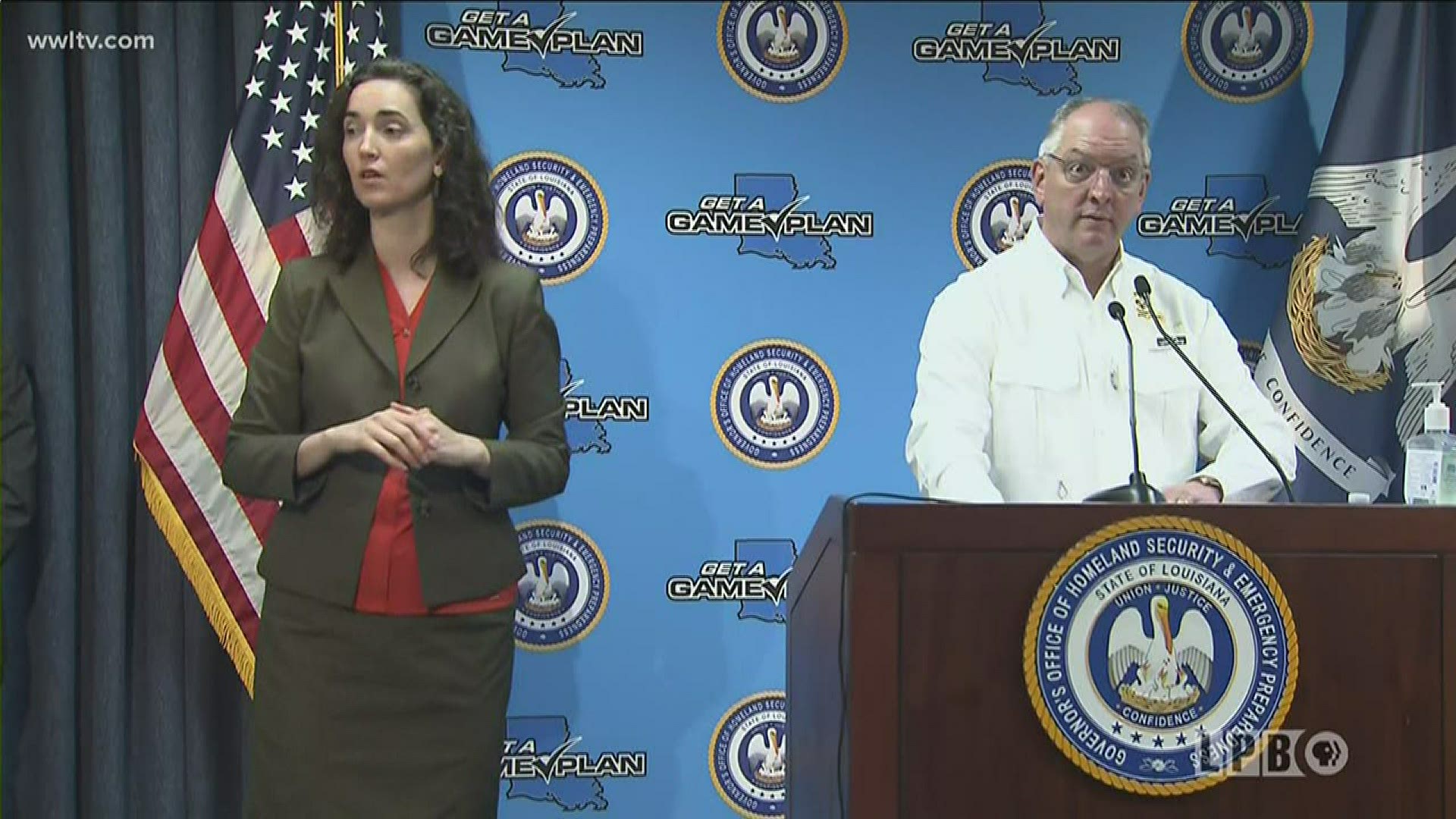

NEW ORLEANS — Wednesday, Gov. John Bel Edwards announced Louisiana has just received its share of funds for coronavirus related unemployment claims.

He said the state will begin paying out the $600 per week in Coronavirus Aid, Relief, and. Economic Security Act (CARES) benefits on Monday.

“This is really important, this includes the 1099, the salon, the gig and other self-employed workers,” Edwards said.

The governor also revealed that 277,000 Louisiana workers filed unemployment claims over the last month alone, including 102,172 last week. That’s compared to 103,000 for all of last year.

The governor said the best hours to file for unemployment benefits are between 10 p.m. and 4 a.m., because of the volume of claims.

He urged people to file online at laworks.net

A new round of weekly jobless claims Thursday morning revealed 6.6 million more Americans filed for unemployment last week. The new numbers mean roughly one in 10 workers have lost their jobs in just the past three weeks.

The report is for claims ending the week of April 4. The figures collectively constitute the largest and fastest string of job losses in records dating to 1948. They paint a picture of a job market that is quickly unraveling as businesses have shut down across the country because of the coronavirus outbreak. More than 20 million American may lose jobs this month

A record 6.6 million new people filed for state unemployment benefits when the report for the week ending March 28 came out. That shattered the record set one week earlier when 3.3 million new claims were filed.

Small businesses in the New Orleans area are struggling financially because of the Coronavirus outbreak.

To make matters worse, they are also having little success accessing the billions of dollars in SBA loans, set aside by Congress to pay employees and business expenses for the next two months.

“We’ve not processed one (loan) because of the system glitches that we’ve seen over the past two days,” Jefferson Financial Credit Union President and CEO Mark Rosa said.

According to Rosa, the SBA website crashed on Tuesday and right now there’s a lot of unanswered questions about the loans. She said because of the glitches, the Paycheck Protection Program has pretty much been on hold.

Nationally, the SBA has generated nearly 400,000 loans for more than $100 billion since the program began on April 3, according to an SBA spokesperson. That's more than $28 billion in loans they gave out for the entirety of 2019.

To find out more about Paycheck Protection Program loans from the SBA, officials say you should start with your current bank or lender. If they're not part of the program, you can find a local lender here.

Tools

► Get breaking news from your neighborhood delivered directly to you by downloading the FREE WWL-TV News app now in the IOS App Store or Google Play.