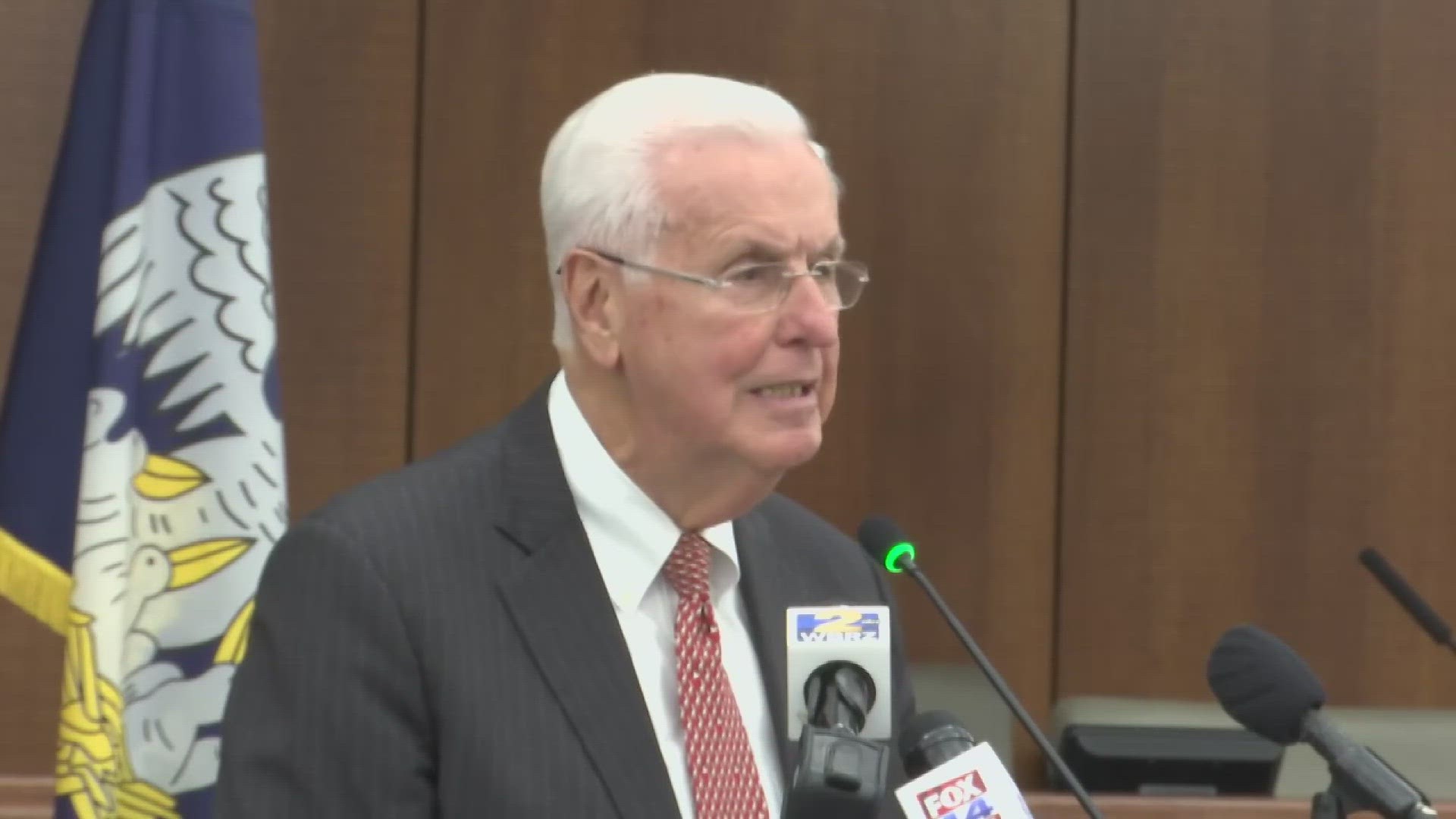

NEW ORLEANS — Louisiana Insurance Commissioner Jim Donelon says sorting out the state’s insurance crisis will now have his full attention.

He cited the ongoing issues with insurance companies dropping out of Louisiana and his age as reasons why he will not seek re-election.

Donelon has spent the past 17 years as commissioner, the longest in state history.

He also spent decades in the state legislature.

“I am obviously 78 years old and have spent almost 50 years serving the public of Louisiana,” Donelon said. “While very healthy and continuing to exercise, I want to enjoy the remaining years of my life with my family and hopefully some new hobbies.”

Donelon promised his last 9 months in office will be “action-packed.”

Priority number one, enticing more insurers to write policies in the state.

Tuesday, he announced nine companies are seeking $62 million in grant money through the Insure Louisiana Incentive Program, recently funded by state lawmakers.

"If all goes well, they should begin writing new policies as soon as next month. I want to express my appreciation to these insurers for their willingness to enter our market at a time when our residents need their support the most.”

Eight of the nine companies are already doing business in the state.

In exchange for the grant money, the insurers have agreed to write a combined 55,000 new property insurance policies in the state.

Half of which must be written in the state’s 37 coastal parishes.

They would have to maintain those new policies for at least 5 years.

“The incentive program is not designed to be a long-term fix,” Rep. Mike Huval, Chairman of the House Insurance Committee, said. “Although attracting several new companies to write insurance, homeowners’ insurance in our state will greatly benefit us in the long term.”

The legislature has put $45 million into the incentive program so far.

Huval, a republican from Breaux Bridge, plans to ask lawmakers to fully fund the $62 million in grant requests during the upcoming legislative session.

A dozen insurers writing policies in the state have failed since 2020's Hurricane Laura.

More than a dozen others have also stopped doing business.

Here is the list of companies that have applied for incentive grants:

- Safe Point Insurance Company asking for $10 million

- Constitution Insurance Company $10 million

- Applied Underwriters $10 million

- Sure Choice Underwriters Reciprocal Exchange $10 million

- Cajun Underwriters Reciprocal Exchange $5 million

- Elevate Reciprocal Exchange $5 million

- Allied Trust Insurance Company $6.5 million

- Gulf States Insurance Company $3.6 million

- Safe Port Insurance Company $2 million.

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.